- SK HYNIX sees that the demand for high -band memory grows 30% annual until 2030

- American tariffs cannot affect South Korean chip manufacturers thanks to the main US investments

- HBM technology stacks vertically chips for greater efficiency and reduced energy consumption

SK Hynix forecasts rapid expansion in the AI memory segment, estimating an annual growth rate of 30% for high band memory (HBM) until 2030.

The company’s projection occurs in the midst of uncertainty around potential US tariffs of approximately 100% in nations semiconductor chips without US manufacturing operations.

While the president of the United States, Donald Trump, said that the tariff plan would be directed to “all chips and semiconductors entering the United States,” South Korean officials indicated that both SK Hynix and Samsung Electronics would not be subject to measures, due to their ongoing investments and planned in the United States.

Market perspective and strategic management

Choi Joon-Yong, HBM Commercial Planning Head in SK Hynix, said: “The demand for the end user’s is practically, very firm and strong … Each client has a different taste.”

“We are sure to provide, to make the right competitive product for customers,” he added.

He also suggested the capital spending of the main cloud service providers such as Amazon, Microsoft and Google could be reviewed up.

Choi believes that the correlation between the expansion of the AI infrastructure and the demand for HBM is direct, although factors such as energy availability in the forecasts were taken into account.

In statements to PakGazette, the company anticipates that the personalized HBM sector will reach tens of billions of dollars by 2030, driven by the performance requirements of advanced IA applications.

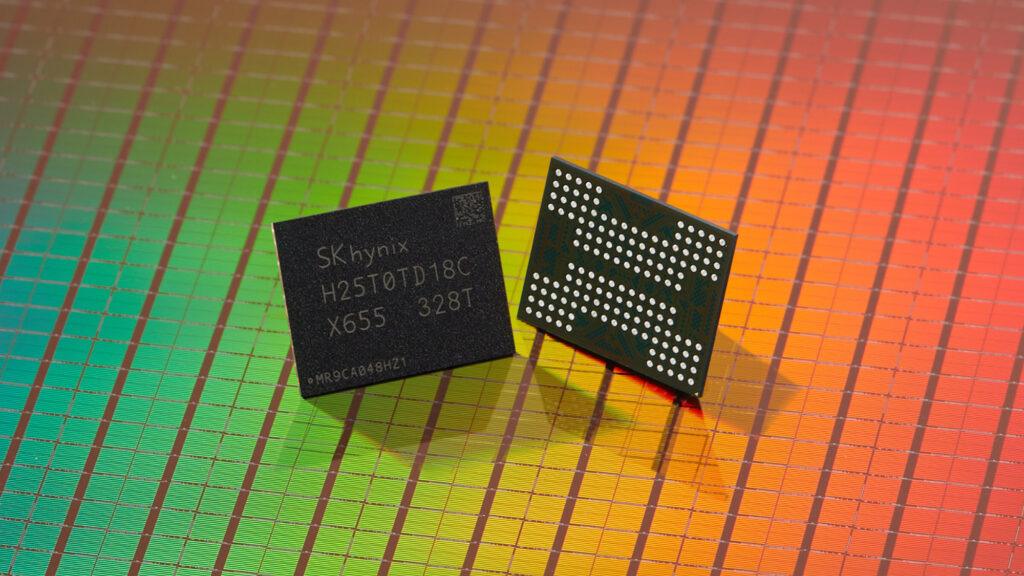

This specialized DRAM technology, first presented in 2013, stives chips vertically to reduce energy consumption and physical footprint while improving data processing efficiency.

SK Hynix and competitors, including Samsung and Micron Technology, are developing HBM4 products that make up a “base given” for memory management, which makes it difficult to replace rival products.

Currently, larger customers like NVIDIA receive highly personalized solutions, while smaller customers often depend on standardized designs.

The company’s position as the main NVIDIA HBM provider underlines its influence on the AI Hardware space.

However, Samsung recently warned that HBM3E production in the short term could exceed market demand growth, which can press prices.

Despite the discussions of in progress, the confidence of the SK Hynix market remains stable.

The company is investing in manufacturing capacity of the United States, including an advanced chip packaging plant and an AI research center in Indiana, which could help safeguard commercial interruptions.

South Korean chips exports to the US were valued at $ 10.7 billion last year, with HBM shipments to Taiwan for packaging that increase considerably in 2024.

Although SK Hynix optimism reflects the expected increase in AI infrastructure spending, market analysts point out the cyclic nature of the semiconductor industry, where pressures of excess supply and prices are recurring challenges.

The company’s capacity to deliver competitive products in a market increasingly formed by customization could determine its resilience.