Sol, the native token of Solana, was just below $ 200 on Wednesday early after a wave of bullish developments, including a large corporate accumulation and projections of analysts in bold, renewed the impulse in the sixth most valuable cryptocurrency for market capitalization.

On Monday, the Consumer Upexi Inc. (UPXI) brand platform revealed that it had acquired additional 100,000 sol, which raised its total holdings to 1,818,809 Sun worth approximately $ 331 million. The company that is quoted at Nasdaq financed the purchase through an increase in capital and convertible notes of $ 200 million, marking its third successful capital round since launched its Treasury Sun strategy in April.

In a press release, UPEXI said that more than half of his tokens were bought blocked with a discount, which resulted in an unrealized gain of $ 58 million by taking into account both the assessment of the Token and the discounted acquisition cost. Almost all of its sun is now bet, and the company expects to generate up to $ 26 million in annual performance based on the current 8%rate.

The UPEXI CEO, Allan Marshall, framed the strategy as the first model of its kind for the management of Altcoin’s treasure in public markets. “We believe this positions UPEXI as an optimal vehicle for investors looking for exposure to digital assets,” he said. The firm also introduced a new point of valuation reference that calls “basic MNAV”, calculated as the relationship of market capitalization and the value in retained sun dollars. As of July 18, UPEXI quoted 1.2x its Net Sol asset value.

The corporate news coincided with an upward forecast of the popular Pseudonym cryptographic analyst “Christiaan”, who published in X that Solana “is ready for a massive bomb” and could reach $ 400 to $ 500 in this upward market.

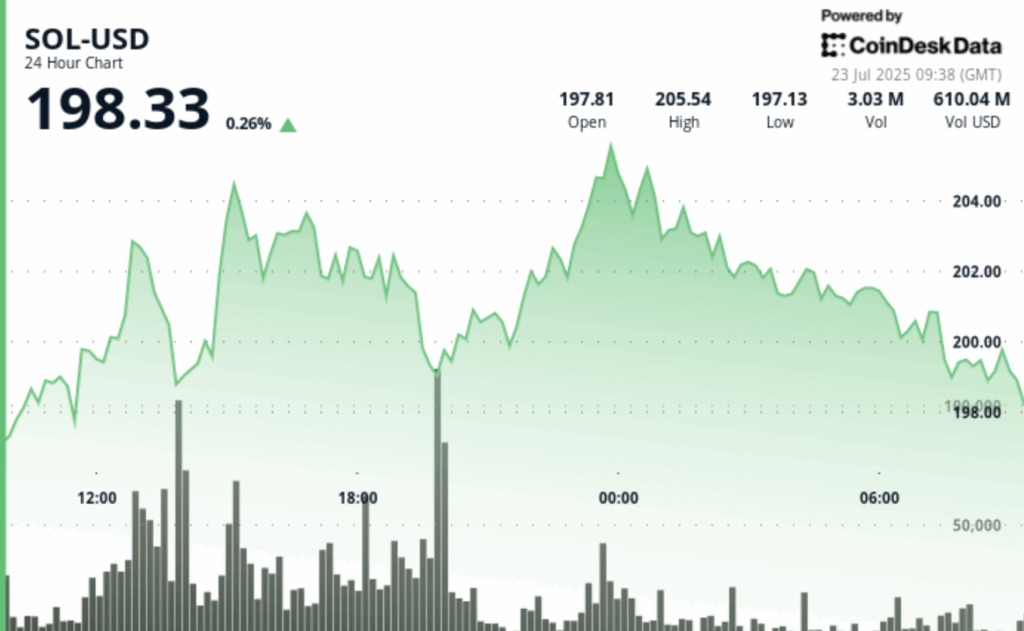

At the time of writing this article, Sol is quoted at $ 198.33, 0.26% more in the last 24 hours, according to Coendesk data. The Token has recovered 20% during the past week, 30% in the last two weeks and 47.6% in the last month, which makes it one of the main performance assets in the this quarter cryptography market.

TECHNICAL ANALYSIS

- According to the technical analysis data of Coindesk Research, Sol quoted within a range of $ 11.48 from July 22 to 09:00 UTC to July 23 at 08:00 UTC, reaching its maximum point at $ 205.99.

- The volume increased to 3.77 million units at 1:00 p.m. UTC on July 22, forming a strong resistance to $ 203.81.

- Sol fell from $ 200.04 to $ 198.95 during the final time, breaking the support level of $ 200 as the institutional sale arose.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.