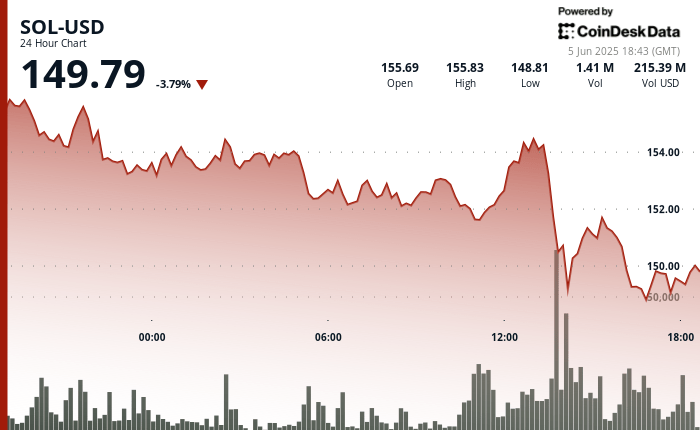

Solana (Sol) continues to face the pending bassist pressure as the price slid below the psychological level of $ 150, marking a 5.2% drop in the last 24 hours.

The mass sale intensified during the early afternoon session with flood exchanges of high -volume shops. Analysts attribute the decline to more than 3 million tokens sun transferred to centralized platforms in the last three days, coinciding with more than $ 468 million in estimated exits.

This significant change in the activity in the chain has questioned the perspectives of short -term recovery, even when the Solana network continues to publish strong use metrics.

With more than 100 million transactions and 7 million active addresses daily, the foundations suggest a long -term strength, but the price action remains disconnected from the protocol yield.

Analysts say that claiming resistance to $ 153 and stabilize above $ 150 is now critical to prevent a deeper setback.

TECHNICAL ANALYSIS

- Sol-USD registered a range of $ 8.19 from the maximum of $ 157.98 to a minimum of $ 149.79.

- The price violated psychological support in $ 150 during a mass increase in volume of 182K at 13:56.

- The resistance remained firm at $ 153.00 since repeated recovery attempts failed during the late session.

- A descending channel has been developed with lower and lowest lower ups and dominant that dominate the graph.

- The volume increases at 13:39 (21k), 13:45 (66k), 13:51 (89k) and 13:56 (182k) confirm the aggressive sale.

- The modest purchase interest is emerging around $ 149.50- $ 150.60, but the downstream persists if the bulls cannot keep the current floor.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.