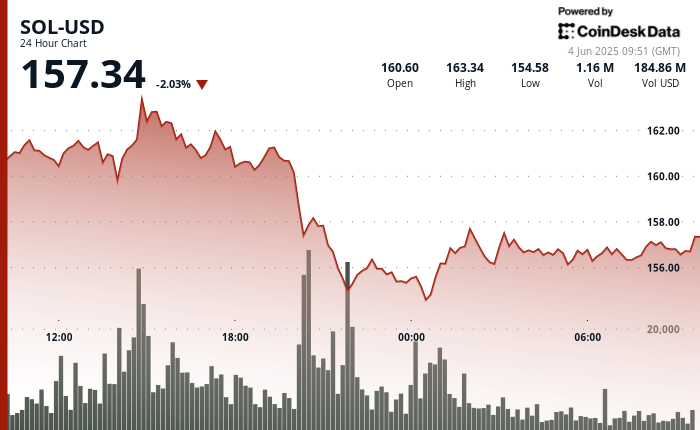

Solana (Sol) saw a strong setback after touching a maximum of $ 163.65, discarding almost 6% before recovering to operate above $ 157 on Tuesday morning. The price action reflects greater market volatility as bulls and bears compete for control near key psychological levels.

Despite the correction, the institutional interest in Sol seems without flinching. The recent presentation of Canary Capital for a Spot Solana ETF and the launch of the Walletconnect token in the network underline the growing adoption of the ecosystem. The data in the chain also admit this narrative, with the increase in daily active addresses and a 26% increase in transactions volumes.

Analysts are still cautiously optimistic, and some point to $ 165 as the next level of resistance to see. Long -term projections remain bullish, reinforced by the large base of the Solana developer base and ecosystem traction as a leading Ethereum alternative.

TECHNICAL ANALYSIS

- Sol quoted in a wide range of $ 9.23 (5.64%), reaching its maximum point at $ 163.65 before falling to $ 154.42.

- The heavy sale of around $ 163.50 led to a strong 4% drop during the window of 20: 00-21: 00.

- The key support was formed to $ 154.50, which caused a recovery at the level of $ 157.

- The immediate resistance is $ 157.70, with a price that currently consolidates just above $ 157.30 Sol bounces from a minimum of $ 156.18 with notable volume peaks around 07:51, confirming a local fund.

- A short-term bullish trend channel was developed between $ 156.40- $ 156.70, now in transition to a broader consolidation above $ 156.50.

- Price volume and structure indicate buyer control at current levels, with a bullish feeling that stabilizes correction