Solana (Sun) remains under pressure as winds against macroeconomic, particularly renewed tariff concerns, shake the trust of investors.

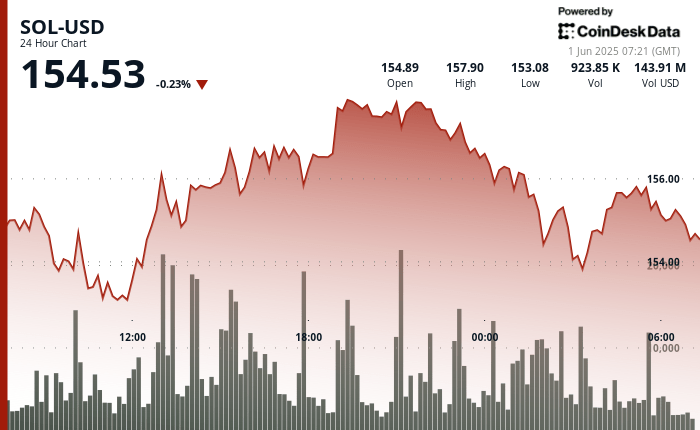

The Token is now around $ 154.50 after establishing a adjusted negotiation range between $ 152.33 and $ 158.06, which reflects a Swing of 3.76% in the last 24 hours, according to the technical analysis data model of COINDESK Research.

Although the highest minimums had previously suggested resilience, Sol fell from $ 156.74 to $ 154.86 in a single hour, breaking under its upward trend channel of mid -April.

Derivative data reflects the bearish feeling: the open interest in Sol futures has dropped 2.47% to $ 7.19 billion, while long liquidations increased to $ 30.97 million, indicating pressure in leverage positions. Short liquidations remain minimal, which reinforces the downward bias.

Even so, institutional interest remains evident. The recent mint of $ 250 million from Circle in Solana has added liquidity and consolidated the stablcoin leadership of the chain, with 34% of the entire volume of Stablecoin now routed through the network. In addition, the validator fund signals of $ 1 billion of Sol Strategies held long -term confidence in the scalability of the protocol, even when the short -term price action fails.

TECHNICAL ANALYSIS

- Sol established a range of 5.73 points ($ 152.33– $ 158.06), indicating an intradic swing of 3.76%.

- The previous price action tracked a clear upward channel with a solid support about $ 152.80, backed by strong accumulation.

- An investment took place in the early hours of the morning, with a sun falling from $ 156.74 to $ 154.86 in a greater sale.

- The short -term impulse became bassist as the lowest ups and downs and the weakest volume defined the final negotiation stretch. When writing, Sol is consolidated about $ 154.50, which suggests the stability of prices but with low risk if the volume does not improve.

External references