If he blinked, it is possible that he has lost it: the futures of Solana Sol began to operate on Monday at the Chicago Mercantile Exchange (CME), the market of US institutions and, unlike the historical debuts of CME for Bitcoin (BTC) and Ether (eth), received little fanfare.

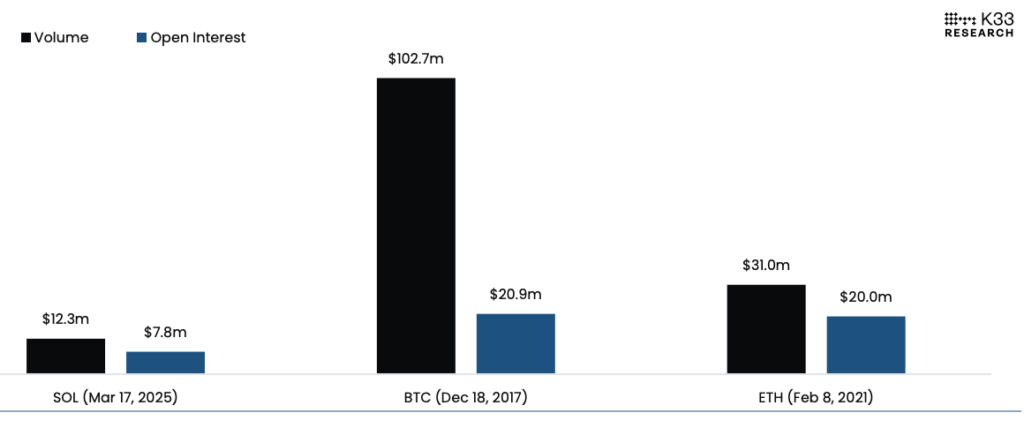

The product booked $ 12.3 million in a notional daily volume on the first day and closed with $ 7.8 million in open interest, without similar debuts of BTC and ETH products, according to K33 research data. For the context, BTC Futures was launched in December 2017 with a volume of the first day of $ 102.7 million and $ 20.9 million in open interest, while ETH Futures debuted in February 2021 with $ 31 million in volume and $ 20 million in open interest, per K33.

Already under pressure due to the implosion of the speculative activity of memory, the bearish cryptographic action and even a failed commercial, Sol fell approximately 10% of its high weekend, with a lower performance of Bitcoin (BTC) and the decreases of ETHER (ETH) 4.5% and 3.8%, respectively.

While the sun’s debut may seem mediocre in absolute terms, it is more in balance with the figures on the first day of BTC and ETH when they fit the market value, K33 analysts Vetle Lunde and David Zimmerman observed. Solana market capitalization was around $ 65 billion on Monday, a fraction of the $ 200 billion ETH and $ 318 billion BTC at the launch of CME.

The launch of CME de Solana also had an unfavorable moment, since market conditions play a crucial role in the future activity, K33 added.

The Bitcoin CME futures reached the top of the 2017 upward market, since the speculative fervor was pressing to the extremes, and the eth debut coincided with the early stages of the Altcoin 2021 rally and the BTC purchase announcement of Tesla, promoting institutional participation. On the contrary, Sun’s futures began to trade as cryptographic markets became bassists, without any greater hype or catalyst that drives the immediate demand of the product, according to the K33 “. It seems that the institutional demand of Altcoins can be superficial, although we notice that the launch of Sol has arisen in a comparative risk environment,” K33 analysts said.

Read more: Samani de Multicoin explains why Sol ETF could defeat Eth

The derivative merchant Josh Lim, founder of Arbelos Markets that was recently acquired by the Falconx main corridor, said the CME product opens new ways for institutions to manage their exposure to Solana, regardless of the demand for the first day. Falconx executed the first Sol Futures Block trade on CME on Monday with the Stonex financial services firm.

“There is enthusiasm for this new CME product launch,” Lim said in a Telegram message. Liquid funds may handle around their sun holdings, including those that bought blocked sheets in the FTX settlement process, he said. In addition, the emitters of funds quoted in the stock market with plans to introduce SOL products could start with ETF based on CME futures.

“People are missing the general panorama in the new CME products,” Lim said. “It will change the access that the coverage funds have in Altcoins.”