Solana sun

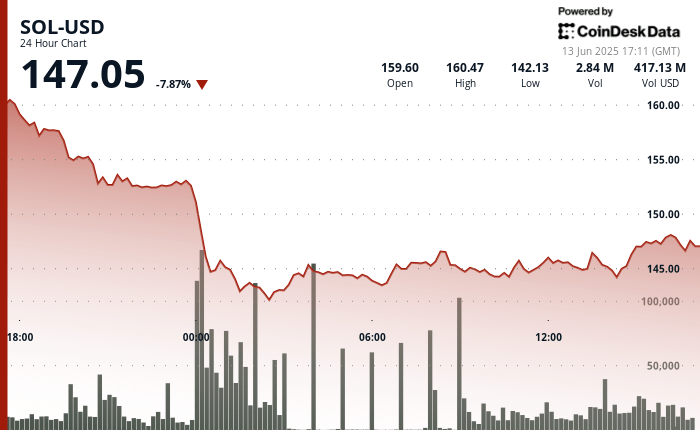

7.87% fell to $ 147.07 in the last 24 hours, since merchants reacted to renewed volatility in cryptographic markets. After opening to $ 159.60, Sol fell sharply during Thursday and the early negotiation on Friday, reaching a minimum of $ 142.13 before stabilizing above the $ 147 mark. The key volume peaks suggest some accumulation near the support, but the general structure remains fragile since the token is quoted almost 40% below its maximum march.

The short -term weakness puts an additional approach at an objective price of May of the Standard Chartered global research team. In a May 27 note that begins the formal sun coverage, the bank predicted that Solana would increase to $ 275 at the end of the year, with a long-term objective of $ 500 by 2029. The report cited the speed and efficiency of Solana as central differentiators, but acknowledged that much of its recent activity driven by Meme-Coin remains strongly discounted by the market.

The growing gap between that bullish perspective and the current conditions of the market illustrates the central dilemma faced by long -term sun investors: whether to treat recent reductions as temporary noise or as a fundamental rejection of the growth narrative. While Standard was expected to wait for a lower performance to the ether in the short term, he positioned the token as a high beta bet in retail ecosystems that could re -qualify if the adoption expands beyond the memecutes.

For now, the price action remains choppy, with buyers who take a step of $ 143 but meet the resistance about $ 150. If Sol can recover positive traction in time to validate even a part of the end of the year forecast can depend on a broader macro stabilization and a renewed activity in the chain in the coming weeks.

TECHNICAL ANALYSIS

- Sol fell 11.87% intra -ease, from $ 160.49 to a minimum of $ 142.13.

- The intense sale occurred between 23: 00–01: 00 UTC before the price was stabilized.

- A adjusted consolidation range was formed between $ 143.50– $ 146.50.

- Higher minimums from 02:00 suggest a possible bullish divergence.

- The volume reached its maximum point at 13:31 (31.8k Sol) and 13:39 (43.4k Sol) as the buyers defended the support.

- The resistance is at $ 152; A previous break could change the short -term trend.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.