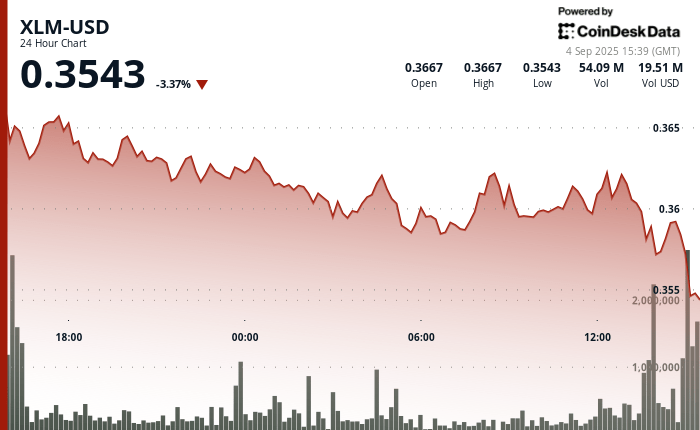

Stellar He continued to slide lower in the last 24 hours, with a price action that underlines a clear bear bias. Between September 3 at 3:00 p.m. and September 4 at 2:00 p.m., XLM showed 2.72%, falling from $ 0.368 to $ 0.358.

The movement occurred within a strict range of $ 0.012, which reflects intradic volatility of 3.26%. Sellers constantly rejected attempts to exceed the level of $ 0.362, particularly during the September 4 session, while the $ 0.357– $ 0.358 area briefly provided support. Even so, the growing downward pressure suggests that the area is not maintained, leaving space for extended weakness.

Market forces seem to be exacerbating the recent Stellar decrease. Despite several bouncing attempts, resistance about $ 0.362 remains firmly intact. These dynamics coincided with the deployment of the update of the Stellar Protocol 23 network on September 3, but the technical milestone could not provide the type of bullish catalyst necessary to counteract the prevailing macro pressures.

Institutional feeling also reflects the cautious tone. On September 2, a wave of liquidations worth approximately $ 192,000 occurred when XLM fell from the range of $ 0.40– $ 0.45, highlighting the vulnerability of merchants to sudden low movements. Since then, this liquidation waterfall has prepared the scenario for the ongoing retirement, which is aligned with larger risk positioning patterns by the main market actors in the midst of geopolitical and monetary uncertainty.

Looking towards the future, Stellar faces a crucial support test. After repeated rejection at the resistance level of $ 0.45, the Token is now drifting towards the demand zone of $ 0.32– $ 0.30. If this level can attract enough purchase interests, you will probably determine the short -term trajectory of XLM. For now, the technical and macro signals point to the sustained bearish impulse unless the most wide stabilize feeling.

Technical indicators indicate more weakness

- The price decreased from $ 0.368 to $ 0.358, which represents a 2.72% drop around 24 hours.

- The general negotiation range reached $ 0.012, equivalent to a volatility of 3.26%.

- Clear resistance established at a level of $ 0.362 with multiple attempts to rejection.

- High volume of 21.47 million during September 4 13:00 The session exceeded the average of 24 hours of 16.23 million.

- The support zone identified around $ 0.357- $ 0.358 seems fragile.

- Accelerating the decrease in the final negotiation hours suggests continuous sales pressure.

- The volume decreased from 28.5 million to 16.7 million shares that indicate weakening impulse.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.