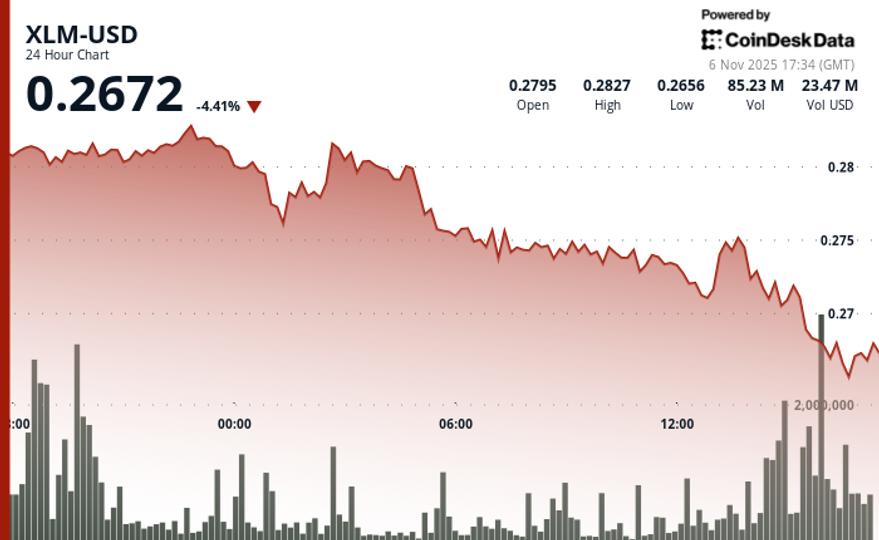

Stellar (XLM) extended its recent decline on Tuesday, falling 2.2% from $0.2789 to $0.2727 as resistance at $0.2815 once again limited bullish momentum. The token traded within a range of $0.0124, reflecting intraday volatility of 4.5%, while a series of lower highs confirmed the prevailing bearish bias. Support remains near $0.2709, reinforced by repeated tests of the psychological level of $0.27.

Trading volume soared to 42.6 million tokens at the $0.2815 resistance zone, a 62% jump above the 24-hour moving average. The rise coincided with institutional selling pressure that rejected further gains and signaled a possible distribution phase. This combination of rising volume and price rejection reinforced the dominance of sellers and underscored the waning bullish conviction.

On the 60-minute chart, a brief recovery attempt between $0.2720 and $0.2755 during the early afternoon gave way to a strong reversal minutes later. The failed breakout caused a rapid drop to $0.2724, accompanied by over 1 million tokens in sales volume in a three-minute period. The pattern confirmed a false breakout scenario and the continuation of the broader downtrend.

As trading momentum faded towards the close, overall volume contracted to just 18% of the session average, highlighting the exhaustion of buying interest. Without a new catalyst or a volume-backed breakout above $0.2815, XLM remains vulnerable to further downside pressure, with short-term traders considering the $0.2709 support level as the next key test.

Support/resistance analysis:

- Primary resistance is at $0.2815 with seller interest confirmed by volume.

- The support zone remains between $0.2709 and $0.2720 after multiple successful tests.

- The psychological level of $0.27 provides a temporary floor amid the session’s volatility.

Volume analysis:

- The trading peak of 42.6 million tokens marked the resistance rejection point.

- Strong selling pressure surpassed 1 million tokens during the afternoon reversal.

- The collapse of volume to 18% of average confirms the slowdown in momentum.

Chart Patterns:

- A downtrend is established by the consecutive formation of lower highs.

- A false breakout pattern was completed within a 60 minute period.

- A reversal candle confirms the institutional distribution at resistance.

Objectives and risk management:

- The immediate support target lies in the $0.2720 area based on recent action.

- A break below $0.2709 accelerates the decline towards the next technical level.

- Resistance remains firm at $0.2815 until a volume-backed breakout emerges.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.