Stellar (XLM) rose in the last 24 hours, posting a 0.85% gain to $0.251 amid muted activity in the altcoin market.

The token underperformed the broader digital asset index by 0.45%, indicating that XLM-specific dynamics drove the price action rather than sector-wide momentum. Trading volume increased 19.36% above the weekly average, suggesting accumulation despite modest price appreciation.

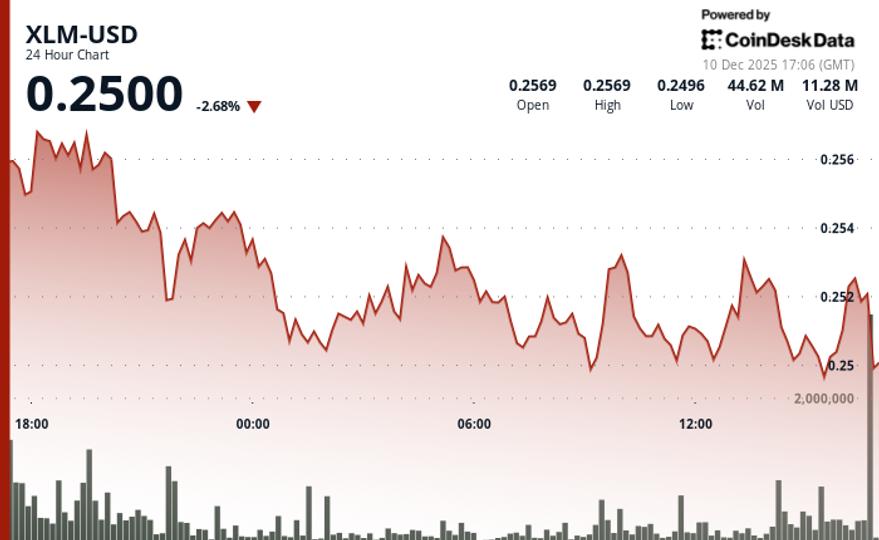

The price action revealed distinct trading in two phases on Wednesday. XLM consolidated around $0.251 until early afternoon before falling to $0.2492 and then recovering methodically to $0.2502.

In the absence of clear fundamental catalysts, technical levels around $0.25 became critical as institutional flows shaped price discovery. High volume without corresponding momentum suggests a showdown between buyers and sellers around current levels.

This pattern usually precedes consolidation breakouts or gradual accumulation phases. The outcome depends on whether institutional interest can overcome the selling pressure at current levels.

Key Technical Levels Signal XLM Consolidation Phase

Support/Resistance: Critical support remains at $0.2500 after multiple successful tests; Resistance forms at $0.2578 after the failure of the initial rise.

Volume analysis: Maximum institutional activity reaches $0.2578 with a 245% increase above the 24-hour averages; Volume depletion marks the end of the session.

Chart Patterns: Volatile sideways consolidation spans a range of $0.0081 (3.2%); systematic decline through a pattern of lower highs.

Objectives and risk/reward: A drop below $0.2500 triggers additional selling pressure; A sustained hold above maintains a bullish structure for breakout potential.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.