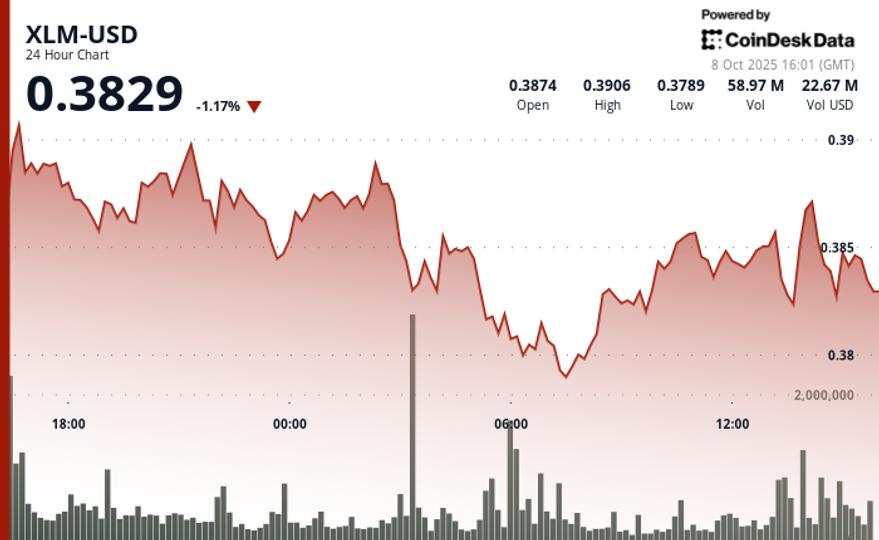

Stellar’s native token, After falling to $0.38 early on October 8, the asset quickly recovered and regained ground above $0.39 by the end of the period, suggesting solid buying activity at lower levels.

During the most recent trading hour, XLM again demonstrated pronounced short-term swings, briefly falling to $0.38 before recovering sharply to reclaim the $0.39 mark. This intraday reversal underscores a strong recovery pattern, suggesting growing market momentum and a possible continuation of the upward trajectory.

Institutional activity appears to be bolstering Stellar’s resilience. Open interest has surpassed $300 million, reflecting growing participation from professional traders and funds. As an ISO 20022-compliant cryptocurrency, XLM is considered strategically positioned for the upcoming Fedwire and SWIFT upgrades in 2025, a narrative that drives institutional confidence in the network’s role in global payments.

The sustained accumulation around $0.38 suggests that large buyers are taking advantage of temporary pullbacks, and rising volumes confirm renewed interest in Stellar’s cross-border payments infrastructure. The consolidation near $0.40 indicates growing market conviction that XLM’s rally could extend further as payments-focused digital assets gain traction.

Technical indicators signal bullish momentum

- Volume analysis reveals increased selling pressure during the early morning hours of October 8, with trading activity culminating in 52.49 million at 06:00, significantly above the 24-hour average of 27.43 million.

- Solid volume support was established around the $0.38-$0.38 zone during the decline phase.

- Volume increases during decline phases, particularly the 1.54 million increase at 13:28 and subsequent periods of high volume, confirmed institutional accumulation at reduced levels.

- The quintessential support and resistance dynamic emerged with substantial buying interest around the $0.38-$0.38 zone.

- The sustained bullish momentum concluded as XLM reached new session highs near $0.39.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.