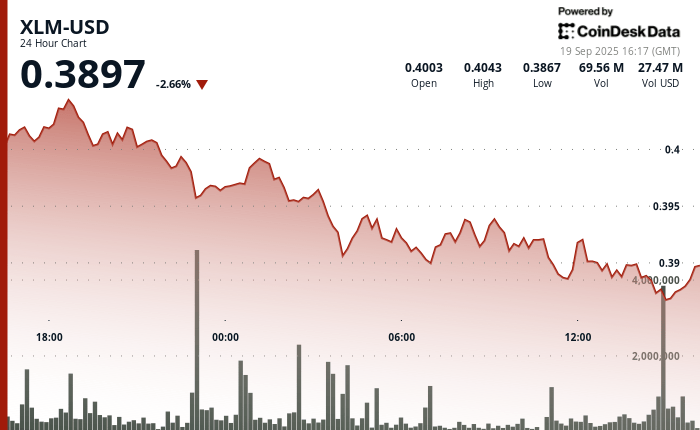

Stellar’s Token XLM fell below the key support in an institutional sales episode, indicating a broader weakness on the market. Between September 18 at 3:00 p.m. and September 19 at 2:00 p.m., XLM fell 3.58% of $ 0.40 to $ 0.39, with volumes exceeding the average of 24 hours of 22.33 million tokens. The analysts pointed out the concentrated sale during the night sessions, traditionally dominated by institutional flows, and the violation of $ 0.40 support as evidence of repositioning before regulatory clarity.

Despite the setback, XLM found a modest relief in the last hour of negotiation, which obtained a gain of 0.05% since the buyers defended the level of $ 0.39. Even so, the broader trend remains bassist, with resistance that consolidates around the threshold of $ 0.40 where previous rebounds have hesitated in a high volume. Technical analysts warned the pattern of low maximum signals and the persistent pressure down.

At the same time, the institutional interest in Stellar’s infrastructure continues to grow. The Stellar Development Foundation highlighted the adoption during its Meridian Conference in Rio de Janeiro, where Centrifuge deployed an asset of $ 20 million in the real world tokenized (Derwa) The Bitcoin initiative and market announced a tokenization program of $ 200 million. Paypal USD Stablcoin also launched in stellar, extending institutional access to the network.

Market indicators reflect institutional repositioning

- XLM violated the critical support at $ 0.40 with negotiation volumes higher than the average of 22.33 million.

- Clear bearish trend established with the formation of lower maximums during the negotiation session.

- Resistance levels were consolidated at $ 0.40- $ 0.40 where recovery attempts faced institutional rejection.

- Intradía volatility reached the range of $ 0.003 between $ 0.39 session peak and $ 0.39 channels.

- The volume increases to 1.13 million units during the sale pressure before institutional stabilization.

- The recovery impulse emerged 0.05% in the last 60 minutes of commercial activity.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.