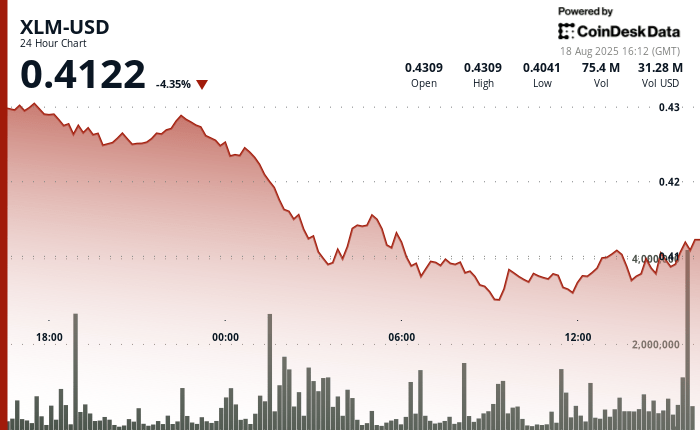

Stellar’s Token XLM was under a strong institutional sales pressure between August 17 at 3:00 pm and August 18 at 2:00 pm, sliding from $ 0.43 to $ 0.41 in a 6%decrease.

Volume trade during the 24 -hour period exceeded $ 30 million, which represents approximately 7% of the daily turnover.

The most notable liquidation event occurred between 1:00 am and 3:00 am on August 18, when institutional sellers downloaded more than 60 million tokens. This sale of XLM sale fell from $ 0.42 to $ 0.41, creating strong resistance at the level of $ 0.42 and defining a new support about $ 0.41.

Despite the recovery attempts, the asset failed to violate the resistance zone, pointing out the persistent institutional support and leaving XLM vulnerable to a greater inconvenience.

The final negotiation time of August 18 added new pressure, since XLM recorded a 1% drop between 1:21 pm and 2:20 pm the accelerated institutional sale between 1:31 pm and 1:42 pm, with corporate settlements that push the prices of $ 0.41 to $ 0.41 in volumes greater than 2.7 million units.

This activity burst confirmed the resistance to $ 0.41 and established a short -term support floor at the same level. Multiple recovery attempts throughout the hour were found with a renewed sales pressure, which culminated in a stagnant closure of around $ 0.41 with a minimum volume in the last 20 minutes.

The lack of purchase interest highlights the possibility of greater weakness if sellers recover the impulse.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Complete AI of Coindesk.