Strategy’s (MSTR) perpetual senior preferred stock, STRF, has increasingly emerged as the company’s most successful lending instrument since its launch in March.

Priced at $110, STRF is up 36% since its issuance and has recovered 20% from its Nov. 21 low of $92. That date also marked bitcoin’s local low near $80,000, highlighting the strong correlation between STRF and bitcoin.

STRF occupies the top level of Strategy’s preferred structure. It pays a fixed 10% annual cash dividend and features governance rights plus penalty-based increases if payments are missed. Even with its premium price pushing the effective yield to around 9.03%, demand remains strong due to the security’s senior protections and long-duration credit profile.

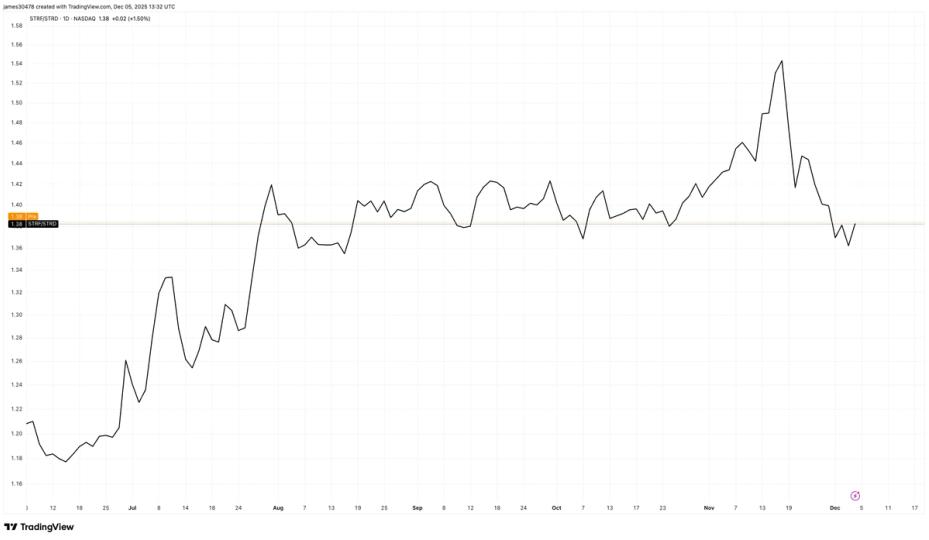

In late October, CEO Michael Saylor highlighted a growing credit spread between STRF and junior STRD. The spread measures the additional yield that investors demand to hold riskier junior securities, which now stands at 12.5%. At the Nov. 21 low, that spread widened to an all-time high of 1.5 as investors flocked to senior exposure, with STRD trading as low as $65. The spread has since normalized to around 1.3.

The divergence is now visible in the Strategy preferred set. STRC, has undergone four dividend rate increases to maintain investor interest.

Strategy’s equity has also recovered, rising from a Dec. 1 low of $155 to around $185, reflecting improved sentiment on both the company’s balance sheet and the bitcoin market since it announced a $1.44 billion cash reserve for preferred dividend payments.