XRP fell over the past 24 hours as an attempted recovery from weekend lows stalled below key resistance, leaving traders weighing initial signs of stabilization against a still fragile technical structure.

Market Overview

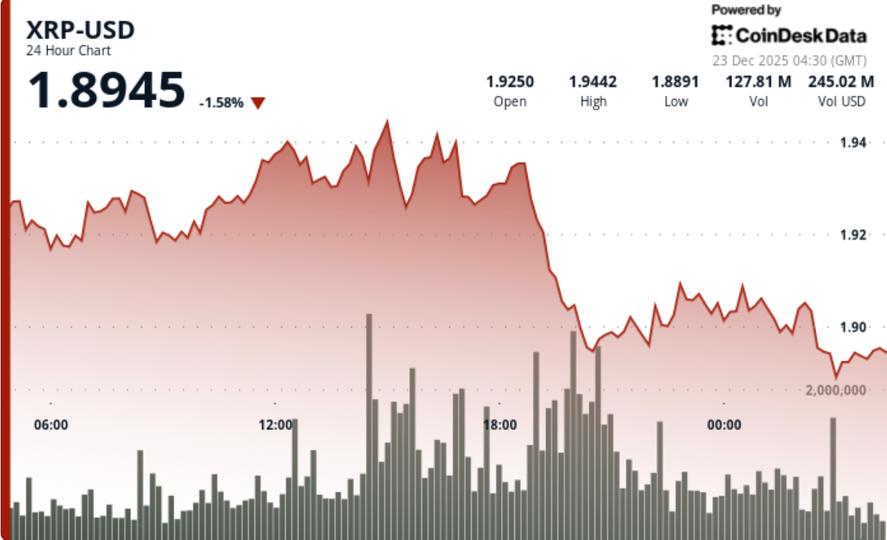

XRP fell around 0.9% over the 24-hour period ending December 23, falling from around $1.92 to $1.90 after failing to maintain momentum towards resistance near $1.95. Price action remained contained within a relatively tight range, with total volatility around 2.7%, reflecting more indecision than capitulation.

Selling pressure intensified on Sunday evening as XRP was rejected near $1.93, triggering a pullback below the psychological level of $1.90. That rejection reinforced a pattern of lower highs that has defined the last few sessions, keeping near-term momentum tilted to the downside.

Technical analysis

The heaviest trading activity occurred around 22:00 UTC on December 22, when volume increased to approximately 74.5 million tokens, approximately 68% above the 24-hour average. The rise coincided with a strong rejection of the resistance near $1.93, confirming active selling rather than passive drift.

After the crash, XRP briefly fell to the $1.89 area, where buyers stepped in to stabilize the price. On shorter time frames, the decline showed signs of slowing, with consecutive candles holding above the session low near $1,893. A short-term rally followed, pushing the price back towards the $1.90-$1.91 zone, albeit without a decisive continuation.

Price Action Summary

- XRP failed to sustain gains above $1.93 after testing resistance near $1.95

- High volume accompanied the rejection, indicating distribution at higher levels.

- The price briefly broke below $1.90 before stabilizing near $1.89-1.90.

- Subsequent rebound attempts lacked momentum, keeping the range intact.

Overall, the session became a consolidation rather than a continuation in either direction.

What traders should keep in mind

Technical signals remain mixed. Some analysts point to emerging bullish divergences in momentum indicators, suggesting that selling pressure may be weakening near recent lows. Others warn that XRP remains below key moving averages on higher time frames, a setup that has historically preceded deeper corrective phases when held.

Key levels now frame the near-term outlook:

- Support: Initial support lies near $1.89, followed by deeper levels around $1.87 and $1.77.

- Endurance: The overall supply remains concentrated between $1.95 and $1.98, and the moving averages reinforce that area.

- Inclination: A sustained recovery of $1.93 would be needed to improve the near-term structure, while a clear break below $1.89 would reopen the downside risk.

Until one of those levels gives way, XRP appears stuck in a consolidation phase, with traders watching for clearer confirmation of trend exhaustion or renewed downward pressure.