Sui

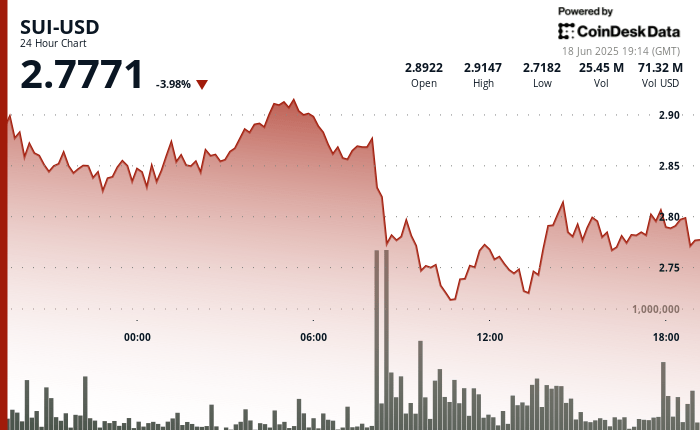

He experienced a turbulent 24 -hour commercial window marked by acute intradic swings and a heavier commercial activity than usual. After initially falling to $ 2.71, the Token set up a brief rally around $ 2.92 before finding strong resistance about $ 2.82. That area limited recovery, causing a quick investment that dragged prices towards the $ 2.78– $ 2.79 area.

What caused the movement to be more notable was the accompanying increase in the 24 -hour negotiation volume, which increased by 11% above the average of 30 days. This level of participation amplified the volatility, with rapid movement changes that expose both bulls and bears to cervical whistle movements. The rejection of $ 2.82 and the failed attempts to resume that level prepared the stage for a more cautious trade in the short term.

The support around the region of $ 2.72– $ 2.75 was lasting, with a price that bouncing in that range several times. As the volume cools and consolidation is tense, SUI can enter a waiting period since merchants reassess the short -term address after the failed break and the unusually active session.

TECHNICAL ANALYSIS

- SUI quoted in a range of 7.3% between $ 2,919 and $ 2,710 during the 24 -hour window.

- The heavy sale arrived at 08:00 when the price fell 9.1% of $ 2,878 to $ 2,765.

- An attempt to rebound around 18:00 sent 1.5% to $ 2,824 in a volume of 1.4 m.

- The rally was invested immediately, with the price falling to $ 2,784 and confirming resistance about $ 2.82.

- The support remained about $ 2.72– $ 2.75 despite multiple tests and consolidation during the session.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.