Sui (sui)

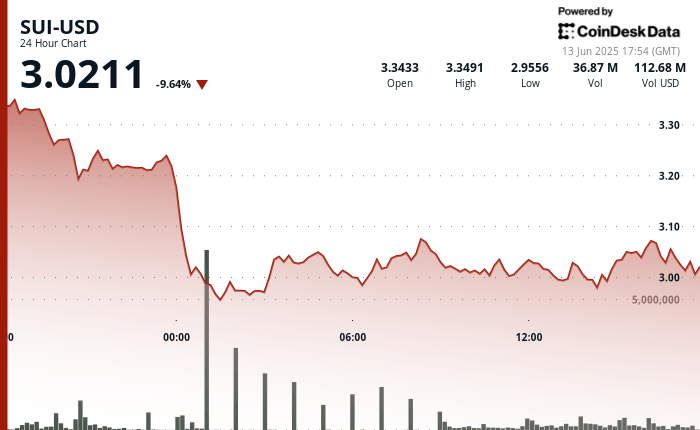

9.64% fell to $ 3,0211 on June 13, extending a strong night correction that saw that the token from $ 3.34 at an intradic minimum of $ 2,9556. The breakdown at $ 3.20, a previously firm support zone, did not accumulate a great sale pressure and marked a turning point in the short -term feeling, with more than 50 million tokens negotiated during the sale of the sale.

After briefly violating the level of $ 3.00, Sui found support from around $ 2,997, where buyers’ interest began to emerge. Since then, the price has been recovered in a narrow consolidation band of $ 3.00– $ 3.05, although the impulse is still fragile. The lower maximums continue to form, which suggests that sellers still have control unless bulls can recover levels higher than $ 3.05 with conviction.

The acute movement follows a wider wave of broader cryptographic weakness and a brief peak in BTC prices linked to the inflation data of the United States earlier this week. While the macro backdrop remains uncertain, Sui prices behavior seems mainly technical: the breakdown of $ 3.20 triggered the cascade casualties and the sale of panic, while the psychological support of about $ 3.00 has temporarily arrested the decrease.

Volume patterns suggest a cautious accumulation, with a notable peak at 14:00 UTC when more than 1.2 million tokens changed hands. However, unless buyers can claim key levels of resistance, the current rebound can be of short duration. A confirmed closure above $ 3.0 would be the first step to invalidate the current descending trend.

TECHNICAL ANALYSIS

- The user interface fell from $ 3,343 to $ 2,9556 in 24 hours, a 12.9% decrease before partial recovery.

- Sell intensified pressure after the breakdown of $ 3.20 at 00:00 UTC, with 50m+ tokens negotiated.

- The price has stabilized in a consolidation band of $ 3.00– $ 3.05.

- A minor recovery raised the price of $ 2,997 to $ 3,017 in the most recent time.

- Volume at 14:00 UTC exceeded 1.2M, pointing out the short -term accumulation near the support.

- The resistance is at $ 3.05; Support is still firm at $ 2.94.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.