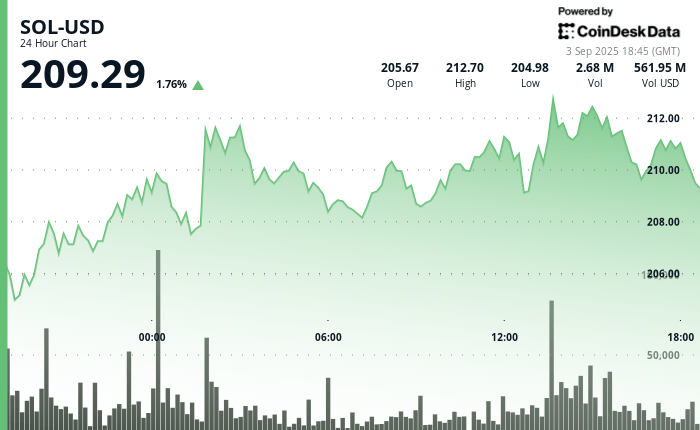

With Bitcoin stuck just above $ 110,000 and ether (Eth) Consolidating after hitting the new records, Solana It has become an outstanding artist in the recently cryptographic market.

The Token quoted around $ 211 on Monday, 33% more than in early August, which makes it one of the best artists in the Coindesk 20 index in the last month. Against Bitcoin, Sol has won 34% during the past month, and has strengthened 14% versus ETH since mid -August.

The rally reflects a broader rotation in Altcoins, analysts said.

“The profit redistribution season among cryptocurrency holders continues,” said Sergei Gorev, Youhodler’s Risk Head of Risk, in a market note shared with Coindesk. He said that liquidity has moved from BTC to second level tokens, with “a notable increase in positive dynamics in capital flows.”

Such flows could be in the long term since corporate investors look for large and liquid projects to maintain, Gorev added, naming Sol together with XRP Like the “Next Interesting Ideas”.

Jeff Dorman, director of Investments of Arca, inclined to Sol to replicate the change of Ether earlier this year. He pointed out Ethereum’s resurgence after the adoption of Stablecoin, strong ETF entries and the relentless offer of digital asset bonds, or DATs, helped ETH recover almost 200% since April.

“Sol seems to be ready to repeat exactly the same play book that ETH has just executed in the coming months,” Dorman wrote in a new report.

The first ETF of Solana on the American list was launched in July, but was based on futures. Several asset administrators, including Vaneck and Fidelity, have requested Spot products with decisions that are due at the end of this year, said Dorman.

Meanwhile, at least three Dats centered in Solana are raising funds that could channel up to $ 2.65 billion in sun during the next month, he added.

In just one fifth of ETH market capitalization, the price of sun could be even more reactive to flows if they materialize.

“Sun could be the most obvious long right now,” said Dorman. “If the price of ETH increased almost 200% by approximately $ 20 billion in new demand, what do you think it happens to Sol by $ 2.5 billion or more new demand?”

Recent news could also increase impulse. The conglomerate of digital assets of the Nasdaq Galaxy Digital List tokenized its actions in Solana, while the approval of the Alpenglow update promises to improve the transaction speed and the purpose.

Read more: Trump, XRP and Sol options indicate a possible Altcoin end of the year: Powertrade