Heavy deleveraging in derivatives markets drags XRP lower before buyers defend the $2.40 zone, establishing a key new support test ahead of Asian trading.

News background

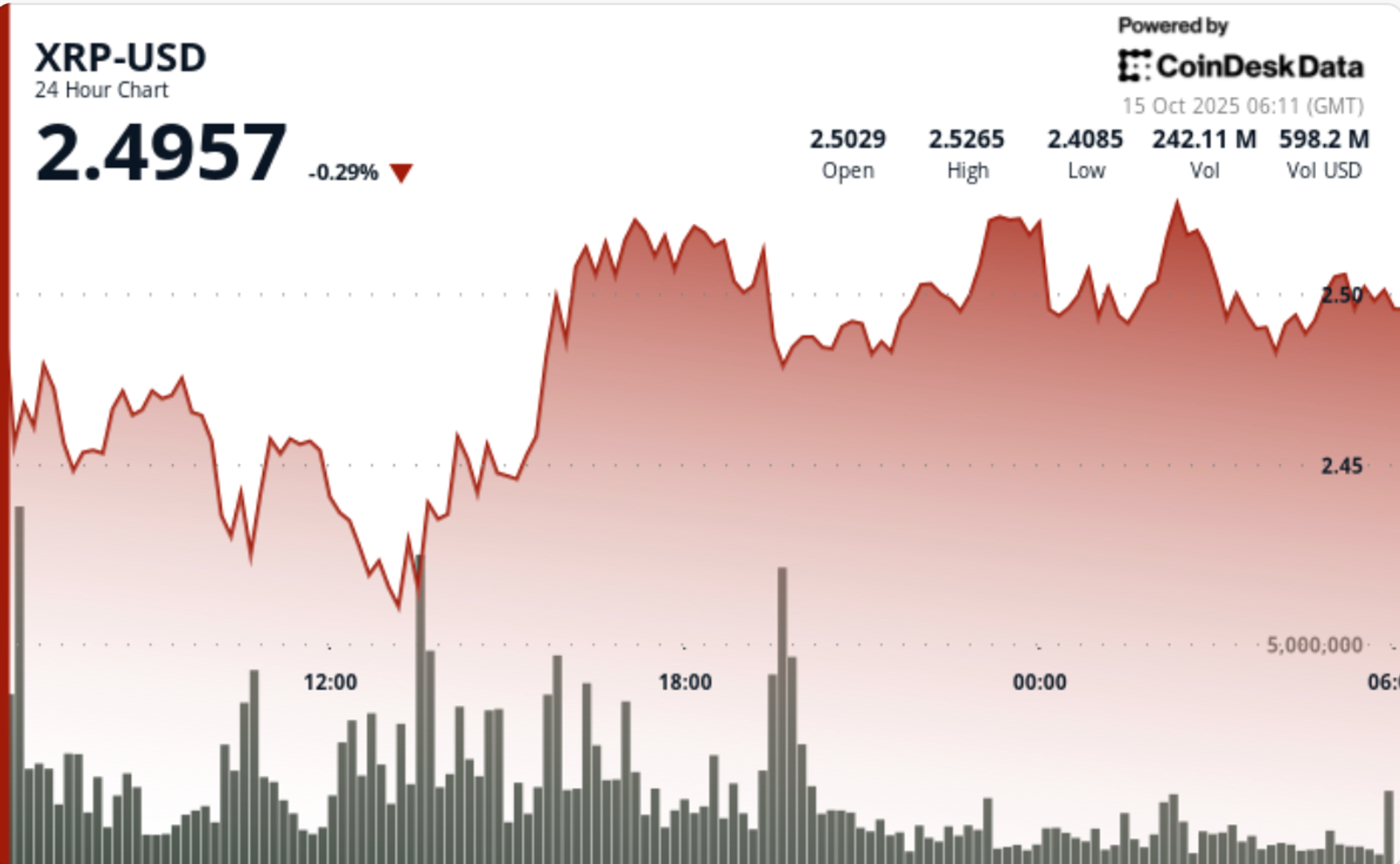

- XRP traded sharply lower during the October 14-15 session as macro pressure and extensive cryptocurrency deleveraging caused open interest to fall 50% to $4.22 billion.

- Despite the drop, spot volumes increased by 40%, indicating an institutional re-entry.

- Ripple’s recently announced partnership with Immunefi: a $200,000 XRP Ledger security trial taking place from October 27 to November 27. 24 – Helped anchor the sentiment after a drop early in the session.

Price Action Summary

- XRP fell 1.97% from $2.54 to $2.49 while swinging through a band of $0.16 ($2.55 to $2.39), about 6% intraday volatility.

- Buyers repeatedly intervened between $2.40 and $2.42, defending key support after a midday capitulation.

- Volume spiked to 179.4M at 1:00 PM, nearly double the 24-hour average, validating the buildup at the lows.

- Sellers limited bounces near $2.53, where the steady distribution formed a short-term ceiling.

- By the end of the session, XRP recovered modestly to $2.50 as dip buying stabilized order books.

Technical analysis

- The area between $2.40 and $2.42 remains the critical pivot for the bulls. Multiple bounces confirm institutional defense, but momentum remains fragile below the resistance group between $2.53 and $2.55.

- A sustained break below $2.40 would open downside targets at $2.33 and $2.25, while reclaiming $2.53 could reestablish an advance towards the broader breakout line at $2.65.

- Volume-weighted metrics point to a buildup amid forced dismantling, a classic near-term base-building phase if funding normalizes.

What traders are watching

- If the $2.40 level continues to hold until Monday’s Asia open.

- Signs of re-leveraging after open interest halved on derivatives exchanges.

- Following volume above $2.50 confirms the accumulation.

- Macroeconomic headlines link trade war rhetoric and Federal Reserve policy as drivers of volatility.