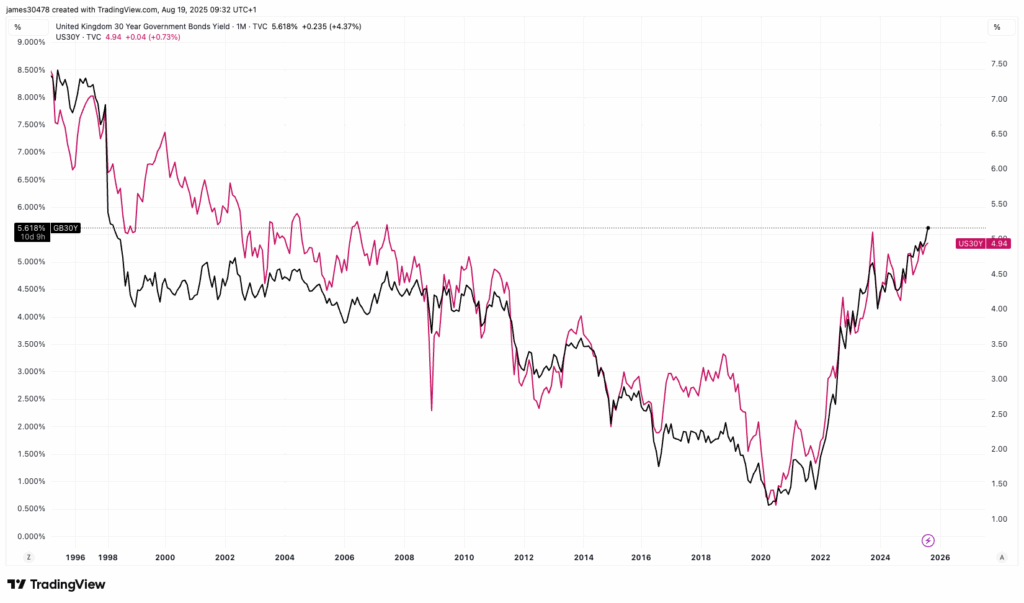

The fragile fiscal situation of the United Kingdom again focuses as the yields of long -term government bonds increased, surpassing their American counterparts for the first time this century.

The United Kingdom government bonus to 30 years offered a yield of 5.61% at the time of publication. That is 68 basic points than the treasure performance of the United States at 30 years according to the View of the Data Fountain.

The wide gap means that the market is demanding a significant premium to have the United Kingdom’s debt versus treasure notes, a sign that investors are becoming more and more cautious about the fiscal situation of the United Kingdom.

The gold market of the United Kingdom (Bond market) He has gained his own life, since the country faces structural economic challenges and long term that has accumulated for decades; However, this is not a unique British theme. Japan, the EU and the United States have also seen bond yields increase as debt loads and inflation pressures increase.

This advanced world indebtedness supports the upward case of the perceived assets of the value store such as Bitcoin

and gold.

Focus on the United Kingdom inflation report

The United Kingdom Inflation Report on Wednesday is essential for bond markets.

The data is expected to show that both the consumer price index (CPI) And the CPI Central remained well above the 2% target in July, according to the negotiating economy of the data source. The main CPI is expected to be 3.7% year after year (above the previous 3.6%)while it is forecast that the inflation of the nucleus will remain at 3.7% (No changes from the previous month). The data will reach the cables only weeks after the Bank of England reduces the 4%rates.

The expectations of sticky inflation could not have arrived at worse, since GDP growth has weakened and unemployment has begun to get higher than secular minimums.

Repeat 2022 crisis?

A hot inflation report could only worsen the dynamics of the debt link by accelerating the upward trend in yields. This requires that both crypto and traditional merchants in the market remain attentive to 2022 style volatility in the United Kingdom markets.

The hardening of the 30 -year -old golden performance, which represents the long end of the curve, played an important role in the investment driven by responsibility (LDI) Pension crisis of 2022, which exploded under Liz Truss. The longer duration yield is now testing the upper limit of a long -term trend and could increase to 5.7%, the highest level since May 1998.

LDI strategies use leverage to collect pension liabilities. When golden yields fired in 2022, collateral so -called a mass sale of gold, creating a feedback cycle that threatened financial stability. That led to the Bank of England to intervene with emergency purchases to avoid a systemic crisis.

If the Wednesday inflation report works longer than expected, golden yields could break new maximums, exerting more pressure on the government and increasing the risk of another LDI -style crisis.