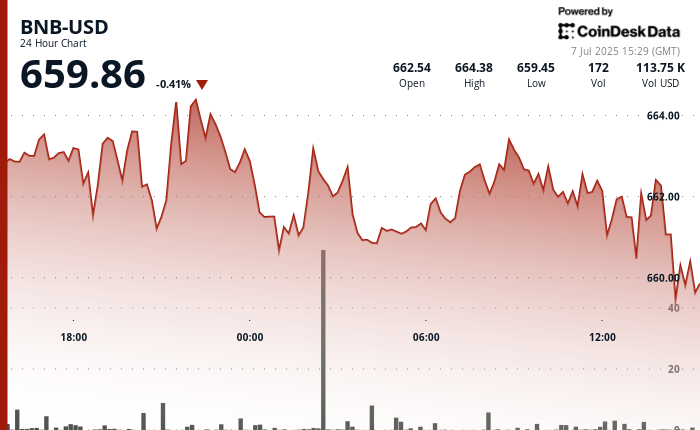

BNB Chain Native Token (BNB) Maintain stable about $ 660, changing in a narrow band of less than 1% in the last 24 hours. The lack of volatility underlines a consolidation pattern.

BNB is quoted at $ 659.61, only 0.5% for the day, and buyers repeatedly intervene around $ 659.45. Meanwhile, sellers blocked advances beyond $ 664,38, a price price that merchants are considering as a potential pitcher for a break if macroeconomic pressures are facilitated, according to the technical analysis model of Coindesk Research.

The chain data points to the mixed feeling among merchants. Financing rates, rates paid among merchants in perpetual futures markets have been reduced, a sign that operators are covering instead of pursuing after the recent Bitcoin rally above $ 109,000.

However, corporate adoption is growing, with Nano Market Labs of Chips that are quoted in Nasdaq, recently acquiring about $ 50 million in BNB as part of its plan to own up to 10% of the global cryptocurrency supply.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.