Dogecoin recovered abruptly from $ 0.21 minimums, closing at $ 0.22 after an increase in the late session in volume and aggressive accumulation of whales, even when the safety risks of the Qubic attack threat persist.

News history

- Dege has faced pressure this month after the reports linked to the possible retouch of Qubic 51% Attack and promoted the sale.

- Despite these risks, the data in the chain shows that the whale cohorts accumulated more than 680 million Duxt in August, compensating for retail departures.

- A broader feeling of the market has been mixed, with Bitcoin and Ethereum consolidating near maximums, leaving Memecoins operating with huge volatility.

Summary of the price action

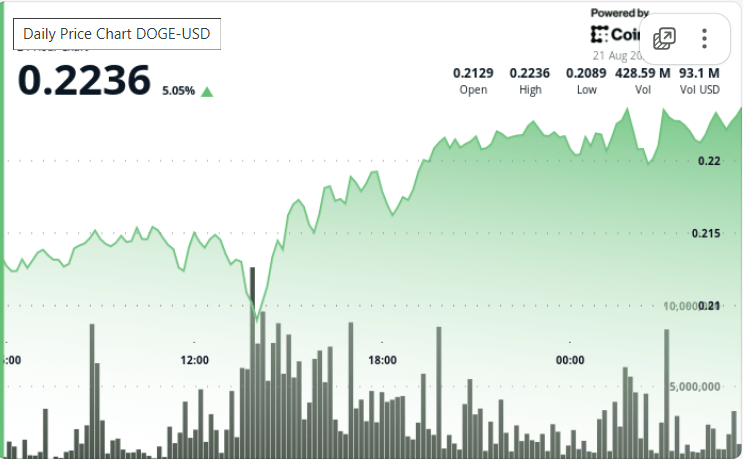

- Dege advanced 5% in the 24 hours ending on August 21, 04:00, recovering from an intra -reduce fund of $ 0.21 to close at $ 0.22.

- The Token reached its session under around 1:00 p.m. UTC on August 20 before reversing the course in a V -shaped recovery.

- The negotiation volume increased to 9.29 million in the final hour, adding 0.45% in the last section and confirming institutional flow flows.

- The whales accumulated 680 million dux to August, positioning despite the ongoing concerns about the potential 51% attack of Qubic.

Technical analysis

- The key support remained at $ 0.21, tested in the middle of the session before high volume reversion.

- The resistance arose at $ 0.22, establishing a negotiation range of $ 0.01 for the session.

- A break was activated at 04:31 UTC with the volume of 9.29 million volume that marks the pivot of the session.

- The sustained billing of 6.8 million per minute during the last hours of hour to larger buyers that lead.

What merchants are seeing

- If $ 0.22 can turn the support resistance, the opening route to $ 0.23– $ 0.24.

- Continuous whale positioning trends in the context of Qubic security concerns.

- Strength of the purchase of monitoring after the explosion of the late session volume, which will confirm whether the recovery in the form of V has legs.