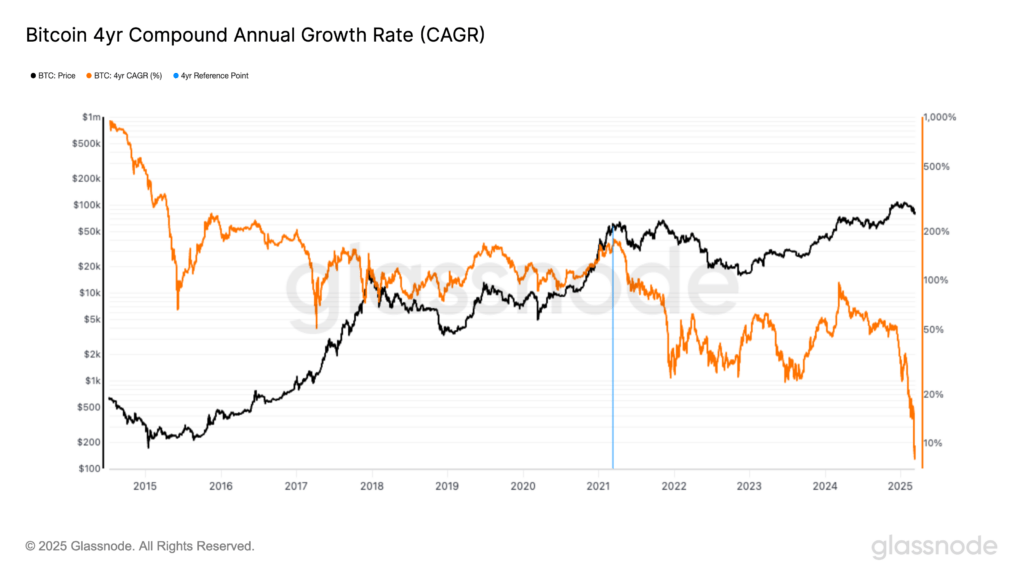

The annual growth rate of four years of Bitcoin (BTC) (CAGR) has fallen to its lowest registered level of 8%, according to Glassnode data.

The four -year period was chosen to align with the middle of half of Bitcoin (BTC) while capturing the typical bull/bears market cycle, which tends to follow a similar time frame.

In March 2021, four years earlier, Bitcoin traded around $ 60,000, near the peak of the previous market cycle. The decrease in Cag is expected since Bitcoin’s volatility and returns decrease over time as the asset matures.

However, this metric depends largely on the reference points. In 2021, Bitcoin was experiencing a top of displacement at the beginning of the cycle, while in March 2025, $ 80,000 could be marking a cycle fund.

The Ether (ETH) -a Bitcoin (ETH/BTC) ratio has also entered 6%negative Cag territory, reflecting the low performance of Ethereum native token compared to Bitcoin. This decrease is mainly due to the ether price that remains essentially flat since February 2021, which is now less than $ 2,000.

Currently, the ETH/BTC ratio is at 0.024, marking its lowest level since the late 2020.

Discharge of responsibility: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.