Dogecoin organized acute price swings during the negotiation window from September 5 to 6, increasing almost 1% as the volume increased by 29% above weekly averages. Buyers quickly absorbed a noon sale at $ 0.213, underlining institutional support and speculation driven by ETF. Merchants now see $ 0.22 as the key break threshold that could define the short -term impulse.

News history

• Dogecoin reached a local maximum of $ 0.2157It is its strongest level in weeks, with the volume of negotiation 29.19% above the weekly reference points.

• Reports of a Dogecoin Treasury Initiative of $ 200 millionDirected by Elon Musk’s legal advisor, promoting institutional credibility.

• According to the reports, the actions of REX and the funds of Águilas fishermen presented the First ETF applications of US Dogecoin.With expected decisions in October.

• Future activity increased by 119% in August, which reflects a high institutional positioning around digital assets based on memes.

Summary of the price action

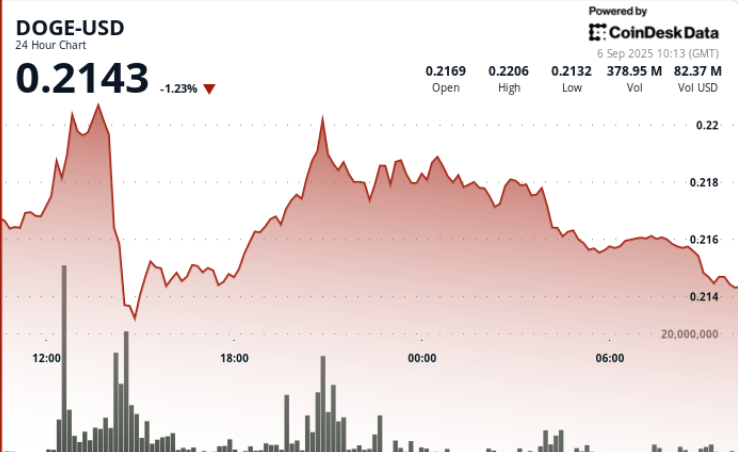

• Doge negotiated a $ 0.008 range (3.6%) Between $ 0.213 and $ 0.221.

• The most steep movement hit at 14:00, when the price fell from $ 0.220 to $ 0.213 in 1.31b volumeestablishing robust support.

• The recovery returned to Doge to $ 0.216 for closing the session, and the buyers constantly defended the area of $ 0.213– $ 0.214.

• The window of 05: 13–06: 12 saw a resistance rupture over $ 0.2157 in 3.06m volumehinting at renewed bullish pressure.

Technical analysis

• Support: Base at $ 0.213– $ 0.214, validated by a 1.3b volume during the sale of the sale.

• Endurance: Transparent roof to $ 0.220– $ 0.221, with multiple rejections.

• Impulse: The breakup attempt at $ 0.2157 suggests a bullish continuation if $ 0.22 is erased.

• Patterns: Accumulation signals within a tight consolidation band; Descending triangle Dege/BTC broke (Marked by Cryptokaleo).

• Indicators: RSI stable less than mid -50 (Neutral-9); The MACD histogram converges towards a possible bullish crossing.

What merchants are seeing

• If Doge can Sustain closes above $ 0.22 To activate an extended rally.

• Institutional flows tied to Treasury initiative of $ 200 million and potential ETF approval.

• Projected rupture objectives between $ 0.30– $ 0.35 If the resistance is cleaned; The risk of inconvenience remains towards $ 0.21 support.