The cryptocurrency market shows signs of renewed force, since the nearby protocol was broken through a key resistance level during the final negotiation time of July 7. The decisive movement occurred in an exceptional volume that was 61% higher than the daily average, confirming the validity of the rupture of an ascending triangle pattern that had been formed throughout the day.

The negotiation data show a strong support established in the range of $ 2.16- $ 2.17 with multiple rebounds before finally exceeding the resistance to $ 2.19- $ 2.20. The advance was particularly remarkable during the 60 -minute period that ended at 14:04, when it almost increased 1.13% of $ 2.17 to $ 2.19, forming what analysts describe as a cup of textbooks and a handling pattern.

This technical development occurs when the broader cryptographic market experiences a significant impulse, with Bitcoin that crosses $ 109K and approaches its historical maximum of $ 111,970.

The total capitalization of the cryptocurrency market has expanded to $ 3.36 billion in a 40% increase in the volume of negotiation, creating favorable conditions for Altcoins such as almost capitalizing on the best feeling in the market. Despite Near’s positive price action, the asset remains significantly below its historical maximum of $ 20.42 reached in January 2022. Current technical indicators have a mixed image, with 14 green days of the last 30, but a RSI of 31.09 that suggests oversized conditions that could support a greater recovery.

Technical analysis

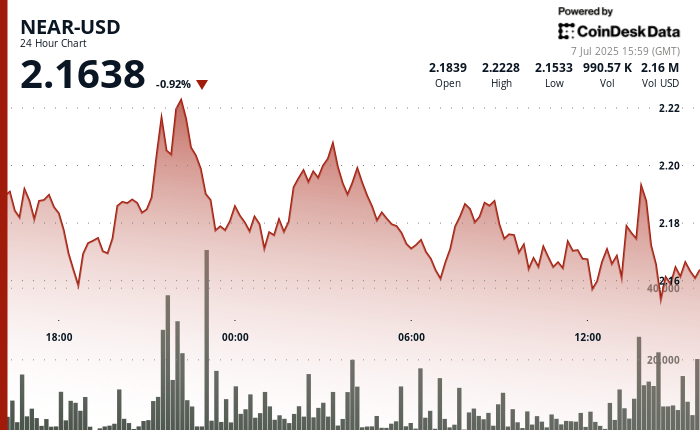

- Near USD exhibited remarkable volatility during the 24 -hour period from July 6 from 3:00 p.m. July 14:00, with a price range of $ 2.16 to $ 2.22, which represents a Swing of 3.15%.

- The asset established key support at $ 2.16- $ 2.17 with multiple rebounds, while the resistance to $ 2.19- $ 2.20 was finally exceeded during the final time in an exceptional volume (1.97m vs. 24 hours of 1.22m).

- The decisive rupture above the level of $ 2.19, together with the formation of an upward rising triangle pattern throughout the period, suggests potential for a continuous continuous impulse with the following resistance objective to $ 2.22.

- During the 60 -minute period from July 7 from 13:05 to 14:04, near USD exhibited a strong upward trend, increasing from $ 2.17 to $ 2.19, which represents a gain of 1.13%.

- The asset broke the key resistance at $ 2.18 with exceptional volume peaks to 13: 57-13: 58 (143,856 units)forming a cup and handling pattern that culminated in a decisive breakup at $ 2.19.

- Support established at $ 2.16 during the recoil of half of the period (13: 17-13: 20) It remained firmly, with the buyers intervening aggressively to feed the posterior rally that reached its maximum point at $ 2.19 before a minor earnings occurred in the final minutes.

CD20 Whipsows 1.17% before finding support

The CD20 index experienced significant volatility in the last 24 hours from July 6 from 3:00 p.m. to 7:00 a.m., with a remarkable price range of 1.17% ($ 21.06) between the maximum of $ 1,793.57 and minimum of $ 1,772.50.

After reaching a peak during the early hours of July 7, the market entered a consolidation phase with a strong 1.17% decrease to $ 1,772.50 at 1:00 p.m. before recovering at $ 1,780.94 at the end of the period, which suggests a potential stabilization after the previous volatility.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.