Global markets are sailing for greater uncertainty after a public dispute between the president of the United States, Donald Trump, and the Tesla CEO, Elon Musk.

The nearby protocol has demonstrated resilience in the midst of this volatility, recovering from a strong 5.2% decrease to establish support in $ 2.42.

The recent price action shows promising signs of accumulation, with an increase in volume in the second support test forming a double potential background pattern in short -time tables.

This technical structure, combined with the successful breakdown above the resistance zone of $ 2.46- $ 2.47, suggests that buyers are recovering control despite the broader market turbulence.

Near’s recovery can indicate a growing institutional confidence in blockchain infrastructure projects useful of the real world.

Technical analysis

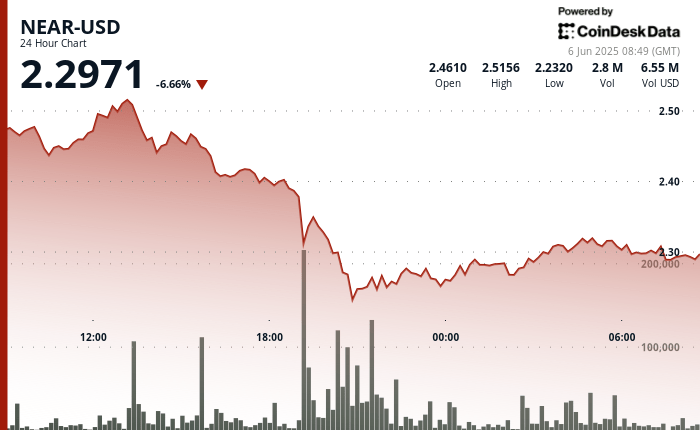

- Near USD exhibited substantial volatility for a period of 24 hours, with a range of 0.132 (5.2%) between the maximum of 2,547 and low of 2,415.

- The asset experienced a strong decrease during the 20:00 on June 4, establishing a key support level in 2,423 with a volume higher than the average of 2.69m.

- A double potential background pattern formed with a growing volume in the second support test, which suggests accumulation at lower levels.

- The resistance established around 2,462-2.470, with the current recovery approaching this critical area.

- In the last hour, the near USD demonstrated a significant bullish impulse, rising from 2,433 to 2,455, which represents a 0.9%gain.

- The price of the action formed a clear bullish trend with notable volume peaks at 07:15 (206k) and 07:37 (120k), indicating a strong interest of the buyer.

- A temporary peak of 2,462 was reached at 07:34 before a strong setback at 2,445, establishing a new support level.

- The recovery of this fall culminated in a final thrust at 2,458 at 07:54, followed by consolidation around 2,455.

Discharge of responsibility: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.