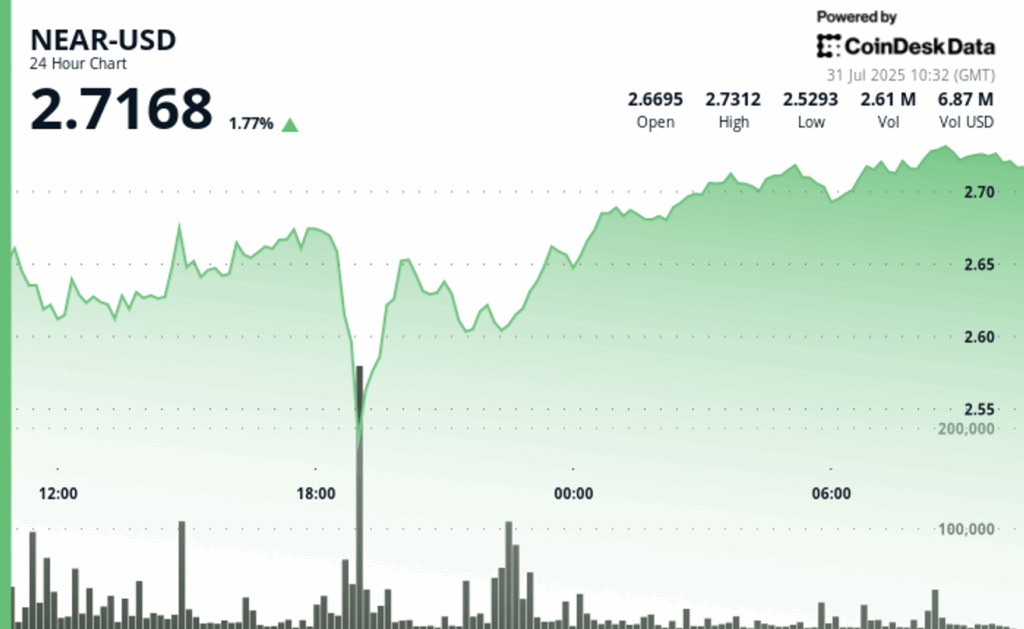

The near protocol demonstrated a formidable resilience during the negotiation session from July 30 to 31, abruptly recovering from the minimums of half of the $ 2.52 session to close to $ 2.73. The rebound, as for a rebound of 8.27%, coincided with the high volume activity, particularly between corporate trade desks and institutional asset administrators. Analysts interpret this as a sign of strategic accumulation, probably driven by the growing confidence in the ambitions of Blockchain business closely.

The institutional activity was more evident on July 30 between 6:00 p.m. and 7:00 p.m., when it experienced a strong drop from $ 2.68 to $ 2.52 in a volume peak greater than 9.60 million shares. This sale of the sale defined a critical accumulation zone. From that base, almost recovered through the session during the night, with corporate merchants who defend the support level of $ 2.52 and the positions methodically accumulated.

The final negotiation time on July 31, from 09:05 to 10: 04, offered more evidence of institutional participation. Although the main profits for that time were modest in just 0.15%, the sustained volume increases above 28,000 shares per transaction pushed near resistance to $ 2,725. Strategic purchases at 09:17, 09:25, 09:52 and 10:01 highlighted the positioning coordinated by sophisticated investors preparing for long -term business adoption.

Industry experts indicate that Near’s performance is emblematic of a broader trend in which institutional investors selectively assign capital to the layer 1 block chain protocols with perceived business integration potential.

Technical Analysis Summary:

- Negotiation range: $ 2.52 (support) to $ 2.74 (resistance), which represents 7.83% volatility.

- Peak volume: 9.60 million actions negotiated during July 30, 18: 00–19: 00 Seloft.

- Institutional accumulation zone: $ 2.52– $ 2.55 identified as key support.

- Final Time Trade (July 31, 09: 05–10: 04):

- Modest profit of 0.15% of $ 2.72 to $ 2.73.

- Volume> 28,000 actions in each strategic entry (09:17, 09:25, 09:52, 10:01).

- Resistance to $ 2,725 raped decisively.

- Net session gain: +2.87% in 23 hours.

- Cumulative institutional rebound: +8.27% of $ 2.52 to $ 2.73.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.