An Ethereum user kept several Makerdao positions from the edge of a $ 360 million liquidation waterfall on Tuesday, adding warranty at the final time as the ETH price fell.

One of the positions had a liquidation price of $ 1,928, this was activated together with a market drop during the negotiation hours of the United States. The ETH was less than two minutes after being liquidated and sold in a Makerdao auction until the owner of the wallet deposited 2,000 Eth of Bitfinex as an additional guarantee. He also paid $ 1.5 million in Dai Stablecoin.

The wallet in question took some by surprise when saving the post, since they had previously been inactive since November.

That particular position is not yet out of the forest; It will be settled if ETH falls to $ 1,781 or until the owner adds more guarantees. Ether is currently quoted at $ 1,928 that bounced from the minimum of Monday of $ 1,788.

It is suspected that another wallet, which according to X Lookonchain of the X account is the Ethereum Foundation, deposited 30,098 ETH ($ 56.08m) to reduce the liquidation price of its position to $ 1,127.

While hundreds of millions of dollars in liquidations are quite common in derivative markets, decentralized finance protocols (Defi) as Makerdao use only spot assets. This means that when a liquidation takes place, defi liquidity cannot face the bias of the supply of specific assets. This does not occur in derived exchanges, since there is generally more volume and liquidity driven by leverage.

In this case, only one of the liquidation of nine figures in Markerdao would probably send the drop in the price of ETH, liquidated the other vulnerable position on its path.

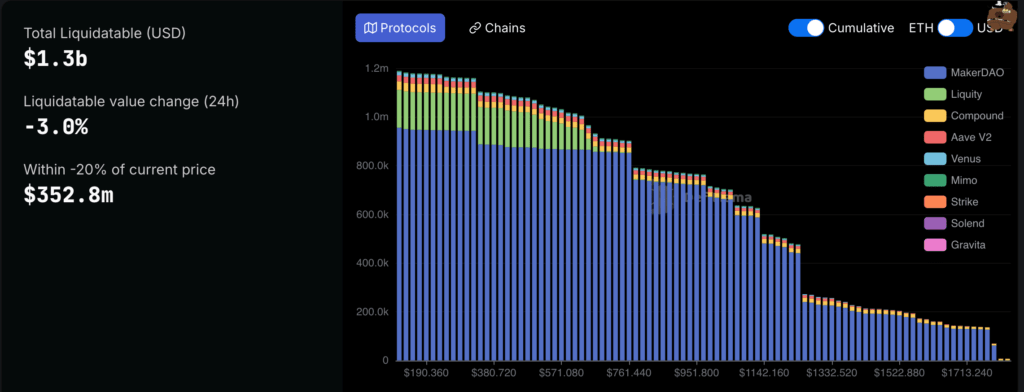

Larride shows that there are $ 1.3 billion in liquid assets in Ethereum, with $ 352 million of that within 20% of the current price.