Although the Tarife War of President Donald Trump aims to generate a boom in home, the Corporate America Expenditure approach firmly in “bits” instead of “bricks and mortars.”

This contrast is evident in the spending patterns of the magnificent 7 (Mag 7) Actions: a group that includes great capitalization technological companies, including alphabet (Google parent company)Amazon, Apple, Meta Platforms (Facebook and Instagram parent company)Microsoft, Nvidia and Tesla.

These companies are expected to spend $ 650 billion accumulated this year on capital expenses (Capex) and research and development (R&D)according to data tracked by Lloyds Bank. That amount is greater than what the United Kingdom government spends on public investments in a year, the bank said in a note on Thursday.

If that number alone does not impress it, consider this: the total spending of investments throughout the economy in IT teams and software has continued to increase this year, representing 6.1% of GDP, while both private and fixed non -residential investment fixed, excluding, has been reduced for consecutive quarters.

FOMO AND AI

According to the Lloyds FX strategist, Nicholas Kennedy, the decrease in investments in other sectors of the economy could be due to several reasons, including the fear of getting lost (FOMO) About artificial intelligence (AI) boom.

“There may be some explanations in addition to an agglomerate by the expense of IT and the political/commercial uncertainties that could resort; the boom of construction that was activated by the Biden Chips Law, which increased the structures, has vanished, for example.

The picture indicates that US corporate spending on IT teams and software has increased to $ 1.45 billion, representing an increase of 13.6% year after year. The count represents more than 40% of the total private investment of the United States.

The estimation of the GDP of the second quarter of the United States, published by the Office of Economic Analysis earlier this week, showed that private fixed investment increased by 12.4% quarter to fourth.

Meanwhile, investment in sectors that are not IT or the broader economy fell 4.9%, extending the tendency to decrease in three quarters.

Of ‘bricks’ a ‘bits’

This continuous domain of “bits” spending in corporate America should calm the nerves of those concerned that the manufacturing administration approach can move capital away from technological markets, including emerging pathways such as cryptocurrencies.

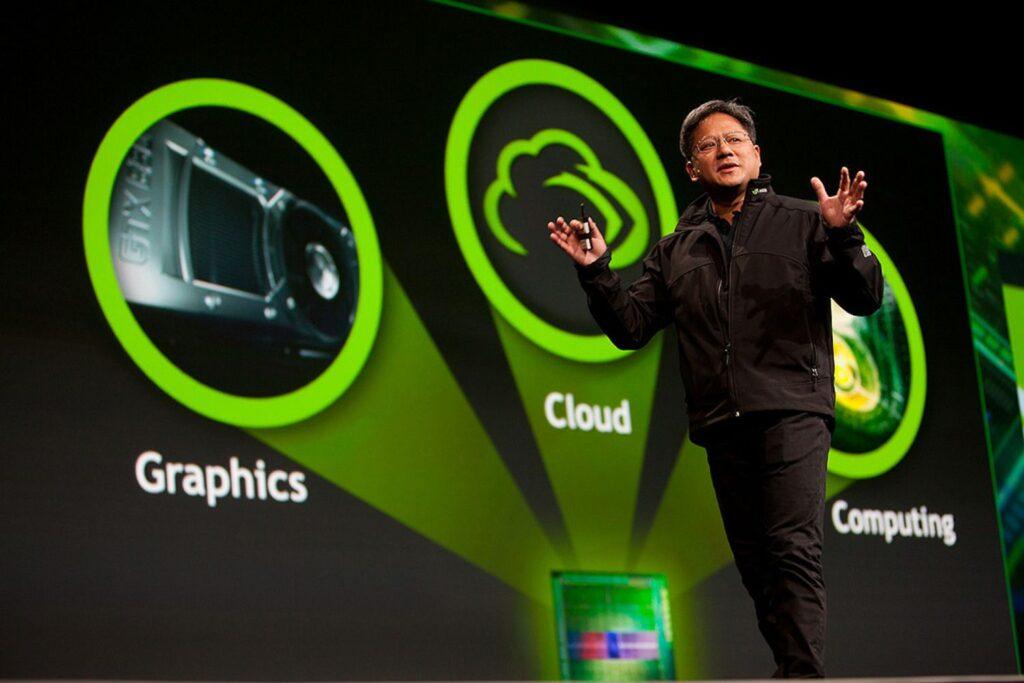

Bitcoin and NVDA, The Bellwether for All Things AI, both played at the end of November 2022 with the launch of Chatgpt and since then they have enjoyed incredible bull races, demonstrating a powerful correlation between the ascent of technology and the cryptographic market.

“If that [AI spending boom] It generates a return is another matter, but reorganizes the plans towards brick bits, “Kennedy said.

In addition, the encryption market has also found a significant tail wind in the form of a favorable regulatory policy under Trump. The administration has demonstrated its pro-Crypto bias through the signing of several key laws aimed at clarifying regulatory supervision for digital and stable assets, including measures that have obtained bipartisan support. In addition, the Administration has made strategic appointments for financial regulatory agencies.