In financial markets, new companies have been about to commercialize as “technology companies” that expect investors to value them with multiples of technology companies. And often they do it, at least for a while.

Traditional institutions learned this in the difficult way. Throughout the 2010, many corporations rushed to reposition themselves as technology companies. Banks, payment processors and retailers began to call themselves Fintechs or data businesses. But few obtained the assessment multiples of the true technological companies, because the foundations rarely coincided with the narrative.

Wework was one of the most infamous examples: a real estate company dressed as a technological platform that finally collapsed under the weight of its own illusion. In financial services, Goldman Sachs launched Marcus in 2016 as a first digital platform to rival consumption fintechs. Despite early traction, the initiative was reduced in 2023 after persistent profitability problems.

JPMorgan declared “a technology company with a bank license”, while BBVA and Wells Fargo invested a lot in the digital transformation. However, few of these efforts produced economy at the platform level. Today, there is a cemetery of such corporate technological delusions, a clear reminder that no amount of brand can cancel the structural limitations of capital intensive or regulated commercial models.

Crypto now faces a similar identity crisis. Defi protocols want to be valued as layer 1. Dapps of the real world asset (RWA) are presented as sovereign networks. All are chasing the 1 “Premium Technology” layer.

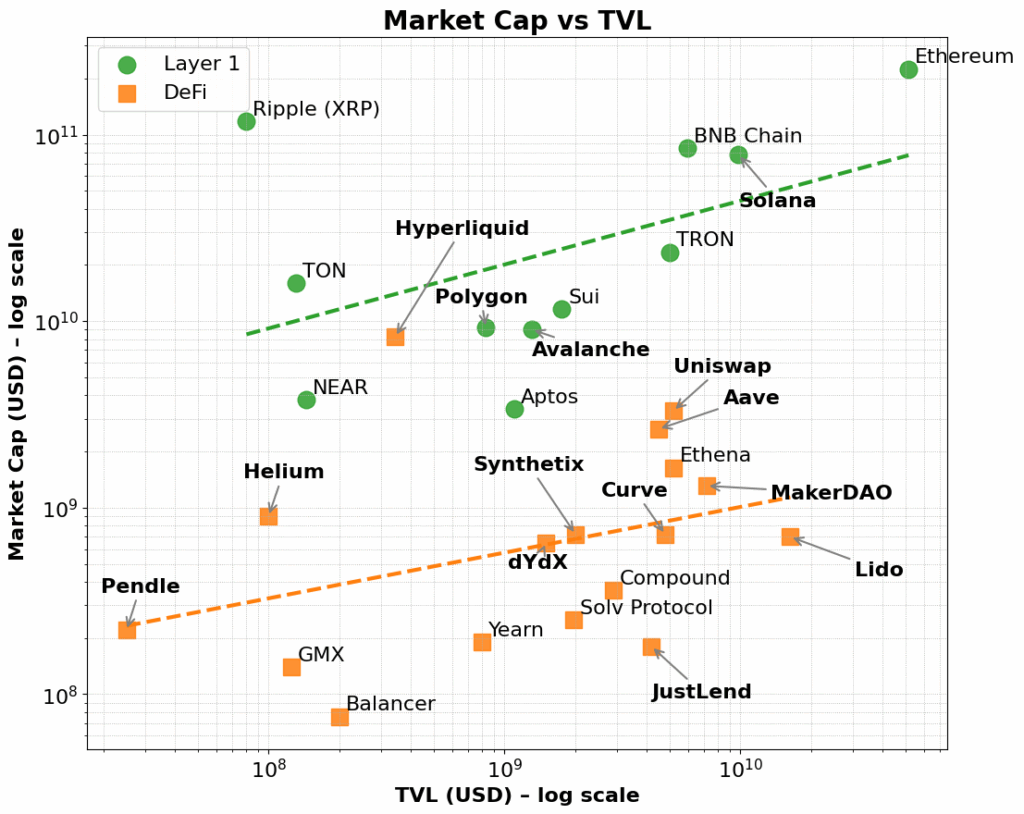

And to be fair, that cousin is real. Capa 1 networks such as Ethereum, Solana and BNB consisting consistently in higher valuation multiples, in relation to metrics such as the total locked value (TVL) and the generation of rates. They benefit from a broader market narrative, one that rewards infrastructure on applications and products on products.

This cousin remains even when the foundations are controlled. Many Defi protocols demonstrate a strong generation of TVL or rates, but still fight to achieve comparable market capitalizations. On the contrary, layer 1 attracts the first users through validator and economy incentives of native tokens, then expand to developer ecosystems and composite applications.

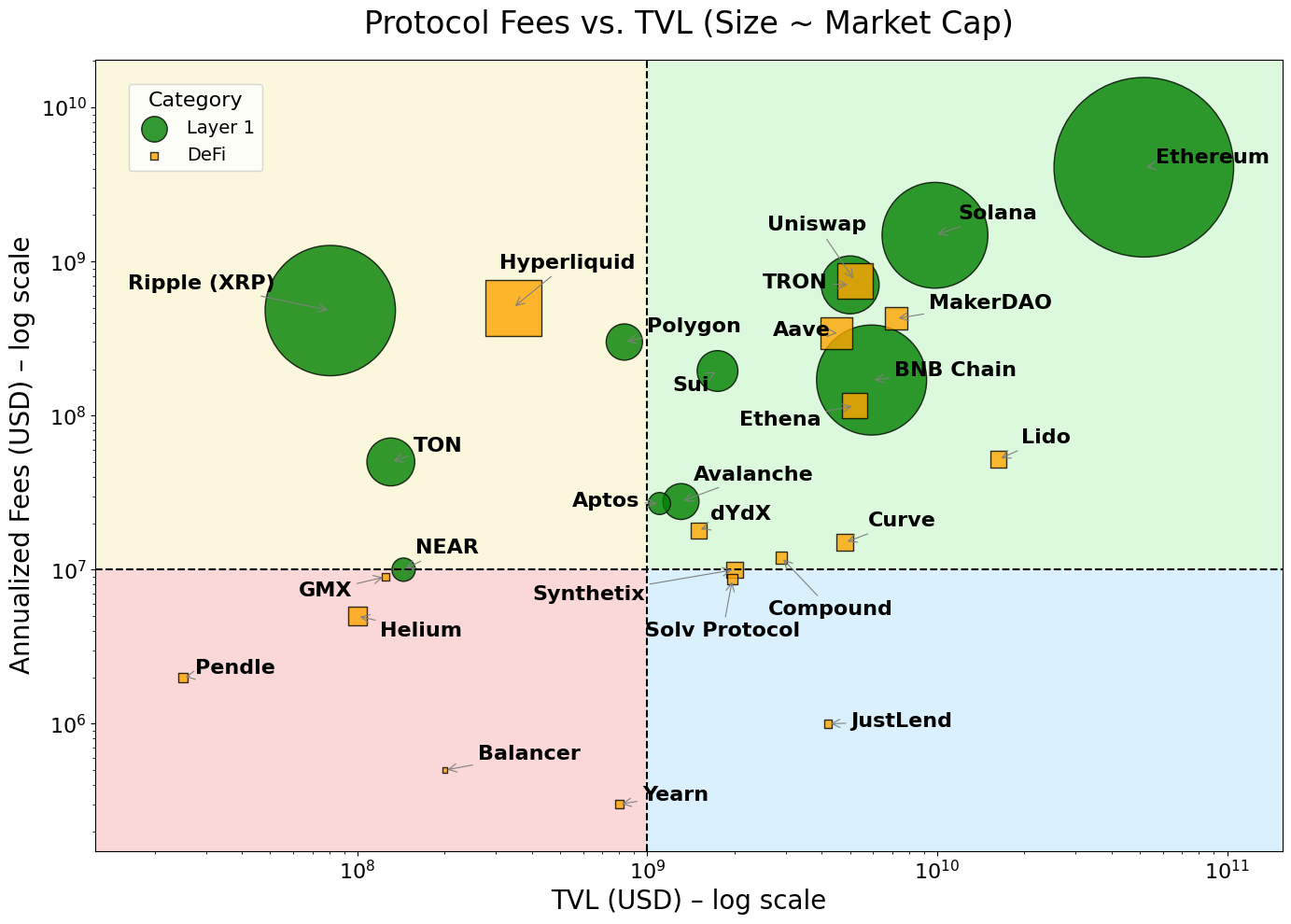

Ultimately, this premium reflects the capacity of layer 1 for a wide utility of native token, coordination of the long -term ecosystem and extensibility. In addition, as the volume of rates grows, these networks often see disproportionate increases in market capitalization, a sign that investors have pricing not only in the current use, but also in the future potential and the effects of the compound network.

This flyer in layers, going from the adoption of infrastructure to ecosystem growth, helps to explain why layer 1 is consistently obtaining higher valuations than DAPP, even when underlying performance metrics seem similar.

This reflects how Variable rent markets distinguish products from products. Infrastructure companies such as AWS, Microsoft Azure, Apple App Store or Meta developers ecosystem are more than service providers: they are ecosystems. They allow thousands of developers and companies to build, climb and interact. Investors allocate higher multiples not only for current income, but for the potential to support emerging use cases, network effects and scale economies. On the contrary, even highly profitable SAAS tools or niche services rarely attract the same valuation premium: its growth is limited by the limited API composition and narrow utility.

The same pattern is now developing among the providers of the large language model (LLM). Most are running to position themselves not as chatbots, but as a fundamental infrastructure for AI applications. Everyone wants to be AWS, not Mailchimp.

Capa 1 in crypto follows a similar logic. They are not just blockchains; They are coordination layers for decentralized calculation and state synchronization. They support a wide range of compound applications and assets. Its native tokens accumulate value through the activity of the base layer: gas rates, stagnation, MEV and more. Crucially, these tokens also serve as mechanisms to encourage developers and users. Capa 1 benefits from self-reference loops, including users, builders, liquidity and demand for tokens, and support the vertical and horizontal scale in the sectors. Read the full article here.

Most protocols, on the contrary, are not infrastructure. They are single -purpose products. Therefore, adding a validator set does not make them layer 1: you simply wear a product in infrastructure optics to justify a higher assessment.

This is where the application’s trend enters the image. Applications combine the application, protocol logic and a settlement layer in an integrated stack vertically. They promise a better tariff capture, user experience and “sovereignty.” In some cases, such as hyperlichids, they deliver. When controlling the full battery, hyperlichid has achieved rapid, excellent UX execution and significant rates, all without depending on Token incentives. Developers can even implement DAPPS in their underlying layer 1, taking advantage of their high -performance decentralized exchange infrastructure. While its reach remains narrow, it offers a vision of some broader scale potential.

But most applications are simply protocols that try to change the name, with little use and without depth of the ecosystem. They are fighting a two -front war: trying to build both infrastructure and a product simultaneously, often without the capital or team work well. The result is a blurry hybrid, not a 1 performing layer, and not a DAPP that defines the category.

We have seen this before. A robbery-asor with an elegant user interface remained a heritage manager. An open API bank was still a balance business. A coworking company with a polished application was still renting office space. Finally, the exaggeration disappears, and the market becomes accordingly.

RWA protocols are now falling into the same trap. Many are positioning themselves as an infrastructure for tokenized finances, but without significant differentiation of existing layer 1 or the sustainable adoption of the user. In the best case, they are vertically integrated products without the need for a sovereign settlement layer. Worse, most have not achieved the adjustment of the product market in their case of central use. They are screwed into the infrastructure and inclined in inflated narratives, hoping to justify the valuations that their economy cannot support.

So what is the way forward?

The answer is not to pretend the infrastructure status. It is to own your role as a product or service, and execute it exceptionally well. If your protocol solves a real problem and drives a significant growth of TVL, that is a solid base. But TVL only will not turn you into a successful application.

What matters most is the real economic activity: TVL that drives the generation of sustainable rates, user retention and the accumulation of clear value for the native token. In addition, if developers are based on their protocol because it is really useful, not because it claims to be infrastructure, the market will reward it. The state of the platform is obtained, it is not claimed.

Some defi protocols, such as Maker/Sky and Unisswap, are following this path. They are evolving towards Appchain style models that improve scalability and network access. But they are doing it from a force position: with established ecosystems, clear monetization and product market adjustment.

In contrast, the emerging RWA space has not yet demonstrated lasting traction. Almost all RWA protocol or centralized service are rushed to launch an application, often backed by a fragile or not proven economy. As with the main protocols that they are transmitted to an Appchain model, the best forward path for RWA protocols is to first take advantage of the existing ecosystems of layer 1, build the user’s traction and the developer that leads to TVL growth, demonstrate the generation of sustainable fees and only evolve towards a model of infrastructure of the Appchain infrastructure, with a clear purpose and a clear purpose.

Therefore, in the case of an appchain, the utility and economy of the underlying application must be the first. Only once they are tested, a transition to a sovereign layer 1 becomes viable. This contrasts with the growth trajectory of general layer 1, which can initially prioritize the construction of an ecosystem of validator and merchant. The generation of early rates is driven by native tokens transactions, and over time, the cross market scale expands the network to include developers and end users, which finally boosts the growth of TVL and diversified rates transmissions.

As mature cryptography, the fog of the storytelling is raising, and investors are becoming more demanding. Fashion words like “Appchain” and “Layer 1” no longer attract attention on their own. Without a clear value proposal, the economy of Sustainable Token and a well -defined strategic trajectory, the protocols lack the fundamental elements required for any credible transition to a true infrastructure.

What cryptography needs, especially in the RWA sector, is no more layer 1. needs better products. And the market will reward those who focus on building exactly that.

Figure 1. Market Captain Vs TVL for Defi and Layer 1s

Figure 2. layer 1 is grouped around higher and dapps rates around lower rates