Islamabad:

The federal government on Monday night made a massive increase in oil products during the next fortnight, seen as an impact of the 12-day Iran-Israel war that almost threatened to wrap the entire Middle East region.

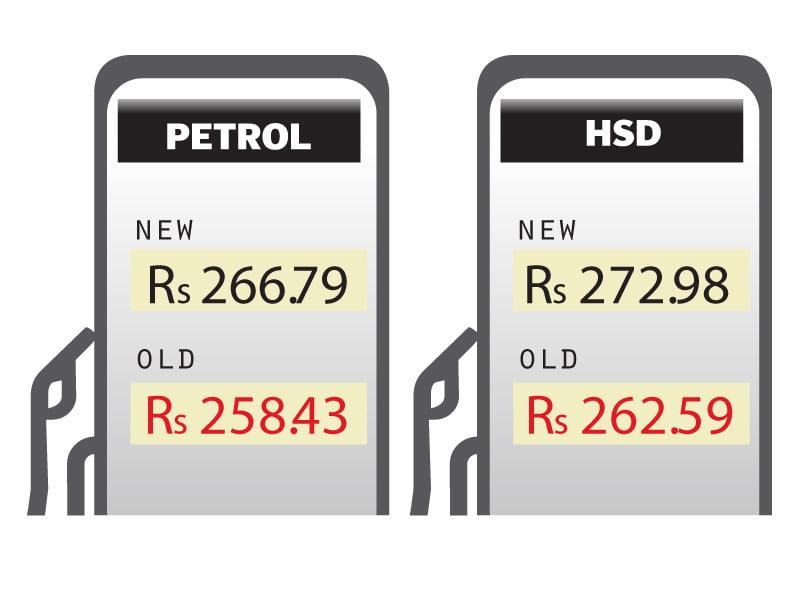

According to a notification issued by the Finance Division, the price of gasoline was reduced in RS8.36 per liter and that of high speed diesel (HSD) in RS10.39 per liter for the period from July 1 to 15. Prices rose in the recommendation of the regulatory authority of Oil y Gas (OGRA).

“The Government has decided to review the prices of oil derived products for the fortnight as of today, based on the recommendations of OGRA and the relevant ministries,” said the notification of the Finance Division.

The notification said that gasoline will now be available at RS266.79 per liter – RS8.36 per liter of RS258.43 per liter. Similarly, the HSD rate rises to RS272.98 per liter of RS262.59 per liter, registering an increase of RS10.39 per liter.

Pakistan is a net importer of oil and imports about 85% of its total requirement of oil derived products, mainly from the Middle East. Local oil and gas companies produce crude oil to meet 15% of total oil needs.

Last month, Israeli air attacks in Iranian nuclear and military sites resulted in a strong increase in crude oil prices that increased from 7-11% to around $ 82-87 per barrel, which was the highest level in six months, according to reports.

This increase occurred after Iran’s threat to close the hormuk strait in the Persian Gulf. However, the ceasefire between Iran and Israel resulted in carrying the price of crude oil to $ 67 per barrel during the period from June 23 to 26, returning at approximately the levels before the war before June 26.

In Pakistan, HSD is widely used in agriculture and transport sectors. Therefore, the new increase in its price will bring an inflationary impact on consumers. Due to its use in the transport sector, the cost of transporting goods will increase, which will result in greater inflation throughout the country.

Gasoline, on the other hand, is used in motorcycles and cars and is considered an alternative to compressed natural gas (CNG). Public gas services had stopped supplying indigenous gas to the CNC stations, especially in Punjab; Therefore, CNC points of sale had been using imported gas for more than a decade.

The recent increase in gasoline prices would also minimize the difference in the price of CNG and gasoline. Prices enter into force on the first day of the new fiscal year 2025-26.

The government has a space to absorb the increase in the prices of oil derived products when adjusting the oil tax. Currently, consumers pay more than 77 rupees per liter of oil and gasoline oil tax. However, the Government had adopted how to increase the prices of oil derived products instead of rescuing consumers from this increase.

Consumers were expected to face more increases in oil prices, since the Government had established an income goal of RS1.4 billion because of the oil tax, the highest in the history of the country. The revised objective of Petroleum Levy was RS1,161 billion for fiscal year 2024–25.

In addition, the government had also imposed a carbon tax on oil derived products that would lead to higher increases in oil products prices.