Grayscale Investments, a cryptographic asset management company that seeks to add funds quoted in XRP and Cardano exchange to their offers, is now starting the route for an ETF that invests in the Token Dot of Polkadot as well.

Nasdaq has submitted a formal application for form 19b-4 before the United States Stock Exchange and Securities Commission (SEC) to enumerate and negotiate the actions of the Grayscale Polkadot Trust (DOT). The presentation begins a 45 -day review period for the regulator to recognize the presentation. The regulator can approve or disapprove of the application or extend the review period.

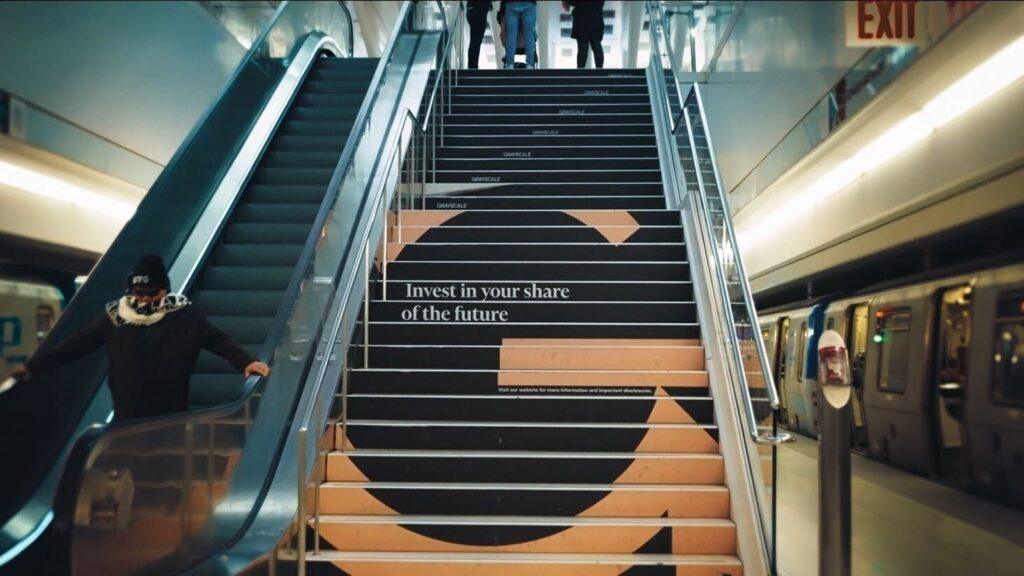

In recent weeks, Grayscale, which already offers ETF of Bitcoin and ether, has presented himself to the SEC to convert his XRP confidence into a quoted background, and presented to list an ETF Cardano Spot. These presentations occur when the SEC revolves to a more friendly approach to the digital asset industry under the Trump administration, after recently eliminated numerous research related to crypto, even against Robinhood and the non -fungible token market.

Grayscale has never offered an independent polkadot product. The presentation is seen by joining Crypto Asset Manager 21Shares, which at the end of last month presented to list an ETF of Polkadot Spot also with the SEC.

The polkadot dot is at the time of writing that is quoted at $ 4.4 after losing 6.7% of its value in the last 24 -hour period in the middle of a recession of the broader cryptocurrency market.