The big question for Bitcoin It is whether base trade, an attempt to benefit from the difference between the spot price and the futures market, will return if the Federal Reserve reduces interest rates on September 17.

There is a 90% chance that the Federal Open Markets Committee reduces the objective rate of federal funds at 25 basic points of its current range of 4.25% -4.50%, according to the CME Fedwatch tool. A change towards a easier policy could cause a renewed demand for leverage, push the premiums of the highest future and breathe life back to a trade that has remained subjected for 2025.

Base trade involves buying bitcoin in the spot market or by means (ETF) While selling futures (or vice versa) to benefit from the price difference. The objective is to capture the differential, since it narrows towards the chain, while limiting exposure to volatility of Bitcoin prices.

With the Fed funds still above 4%, 8%, the annualized yield on base trade may not seem attractive until rate cuts begin to accelerate. It is likely that investors want lower rates to encourage them to enter in base trade instead of just having effective.

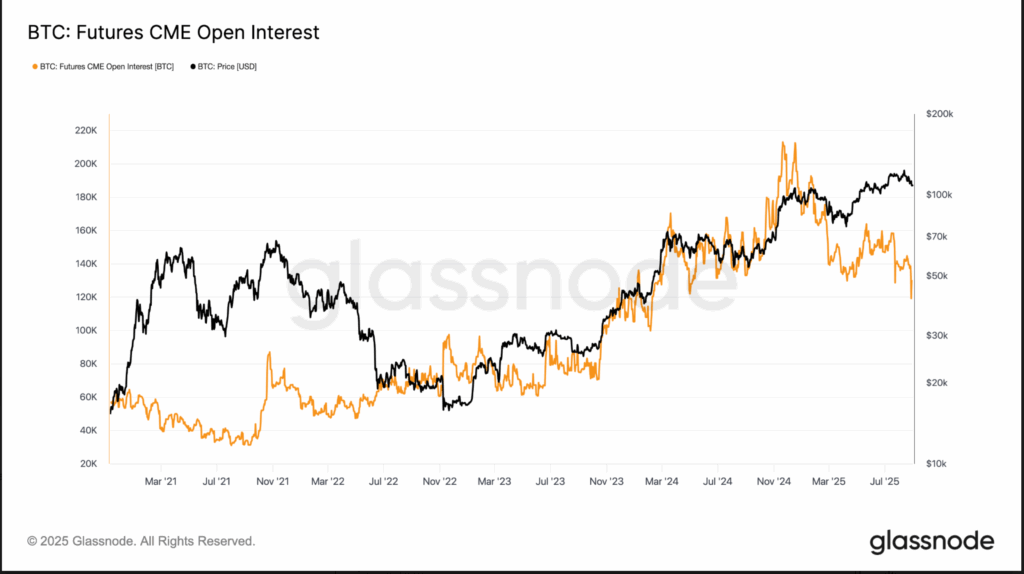

In CME, Bitcoin Futures’s open interest has decreased from more than 212,000 BTC at the beginning of the year to 130,000 BTC, according to Glassnode data. This is more or less the level seen when Bitcoin Etfs Spot was launched in January 2024.

The annualized base has remained below 10% throughout the year, according to veil data, a surprising contrast with 20% seen towards the end of last year. The weakness reflects market and macro forces: stricter financing conditions, ETF tickets that are slowed after the 2024 boom and a rotation of the risk appetite out of bitcoin.

Bitcoin’s compressed negotiation range has reinforced the trend. The implicit volatility, an expected price swing meter, is in just 40 after reaching a minimum record of 35 last week, according to Glassnode data. With suppressed volatility and the light of institutional leverage, futures premiums have remained limited.

If the Fed reduces the rates, the liquidity conditions could be relieved, which increases the demand for risk assets. That in turn can raise the open interest of CME futures and relive the base trade after a year of stagnation.