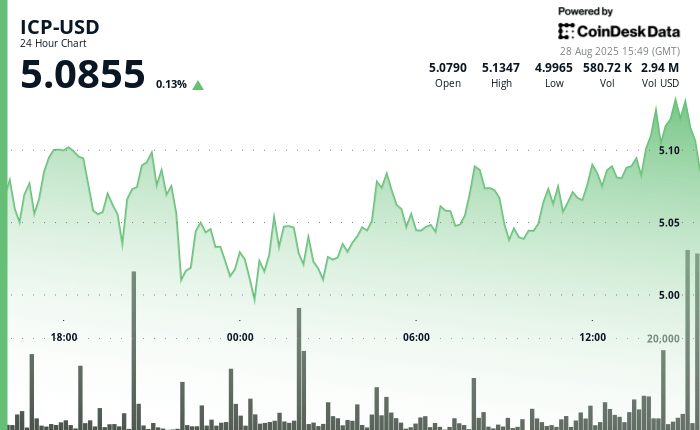

Internet computer protocol (ICP) Resilience demonstrated during the last 24 hours, organizing a rally that raised the token almost 3% to $ 5.13.

The movement limited a V -shaped recovery that began with a retreat during the night to support levels of around $ 4.98, where it seized a high volume of purchase activity, according to the technical analysis data model of Coindesk Research.

After immersing $ 5.07, ICP consolidated within the $ 4.98- $ 5.00 zone, establishing a base reinforced by the negotiation volume of 372,179 units, substantially above the average levels. This accumulation phase marked the turning point, since the purchase pressure increased through the early session.

The impulse was constantly built before completing in a decisive breakdown at the end of the period. ICP increased through multiple resistance barriers to play $ 5.13, with the final progress fed by a volume increase of 272,186 units. The resistance that had previously formed about $ 5.11 was violated, which suggests that sellers were losing control of the short -term trend.

Cryptocurrencies such as ICP seem to be attracting a new interest as alternative asset classes gain traction. The recovery and the great accumulation in the support levels can place ICP for higher profits, with the next technical objective in sight around $ 5.18 based on the Fibonacci extension levels.

Technical analysis

- Trade Corridor: $ 4.98 to $ 5.13, which represents a range of 3%.

- Recovery pattern: V -shaped bounces from $ 5.07 decline to $ 4.98– $ 5.00 support.

- Volume support: 372,179 units at $ 4.98, well above daily averages.

- Resistance: formed around $ 5.11 but broken during the final increase.

- Breakout: prices advanced to $ 5.13 in 272,186 units of units.

- Moment: indicates a strong interest and configuration for a $ 5.18 objective.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.