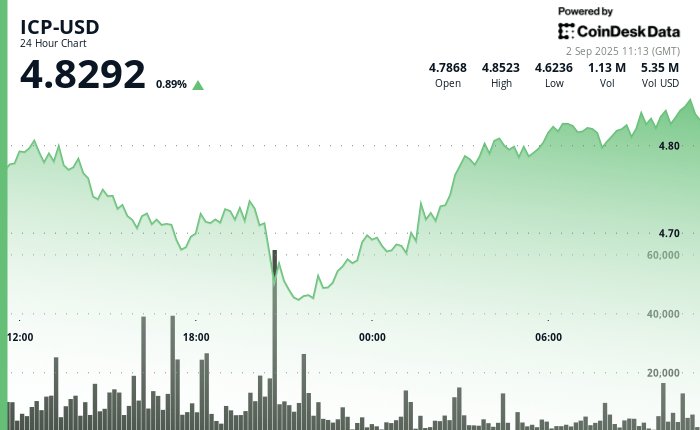

Internet computer protocol (ICP) It showed resilience during the last 24 hours, increasing 2.8 percent, while the broader Coindesk 20 index added only 1.9 percent.

The Token fluctuated through a $ 0.24 band, equal to a 5%swing, which moves between $ 4.60 and $ 4.84, according to the technical analysis data model of Coindesk Research.

The most severe decrease occurred between 20:00 and 9:00 p.m. UTC on September 1, when ICP slide from $ 4.74 to $ 4.60 as the negotiation volume increased to more than 827,000 units, well above the 24 -hour average of 387,000. The lowest price became a support level, attracting more purchase interest.

After the fall, ICP entered a recovery phase, rising to resistance levels around $ 4.83- $ 4.84. The negotiation volume exceeded 26,000 units at key intervals, far exceeding the average per hour of 5,500.

Price Action confirmed a breakup configuration, consolidating in the $ 4.82- $ 4.83 band giving way to a quick impulse towards $ 4.84.

ICP’s ability to attract the sustained interest of the buyer at support levels can strengthen the case of the continuous bullish impulse, with possible upward objectives that emerge in Fibonacci extensions above $ 4.85.

Technical analysis

- ICP negotiated inside a $ 0.24 corridor (5%range) between $ 4.60 and $ 4.84.

- The heavy sale at $ 4.74– $ 4.60 on Monday produced volume peaks of 827,105 and 684,909 units.

- Firmly established support at $ 4.60 with a strong purchase interest.

- The price was constantly recovered at $ 4.84 at 10:00 UTC on Tuesday.

- Identified resistance at $ 4.84.

- Breakout confirmed by volume overthens of 26,939 and 17,946 units.

- The average billing per hour of 5,500 was significantly exceeded during recovery.

- The pattern suggests a continuous impulse with potential to test the highest resistance levels.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.