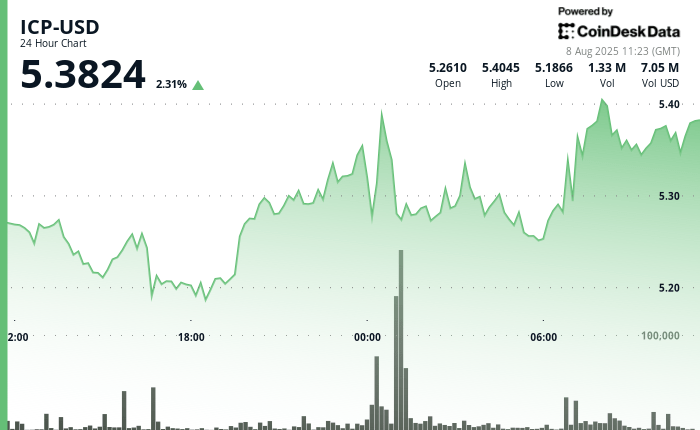

Internet computer protocol (ICP) Extended its upward career in the last 24 hours, increasing 2.29% of $ 5.25 to $ 5.37.

The token price action was developed within a $ 0.26 corridor between $ 5.16 and $ 5.42, which represents a 4.94%negotiation differential, as merchants sailed the pronounced intra -intradia volatility, according to the Coindesk technical analysis data model.

The most notable movements occurred in the early hours of August 8, when the volume increased to 3.13 million units at midnight and then doubled to 6.93 million at 01:00 UTC, both figures beyond the 24 -hour average of 876,000. These tickets constantly complied with offers in the $ 5.24- $ 5.27 zone, which reinforces a support base. On the positive side, sellers were concentrated around $ 5.39– $ 5.42.

Subsequently, ICP advanced from $ 5.36 to $ 5.38, measuring an impulse of 0.37%. This increase was backed by high volumes between 09:50 and 09:55 UTC, ranging from 27,887 to 39,904 units, more than triple the baseline per hour. The rally confirmed $ 5.33- $ 5.34 as an intradic floor, with a break greater than $ 5.36, resistance hints at the highest profits.

Despite the broader mixed feeling of the market, the structure of the ICP graph has been strengthened. The currency capacity to maintain key support levels, combined with a greater volume, underlines continuous institutional participation and growing confidence in the long -term road map of the network, which includes recent performance updates and integration with Bitcoin’s functionality.

TECHNICAL ANALYSIS

- 24-hour price range: $ 5.16- $ 5.42 (4.94% distribution).

- The support is repeatedly confirmed at $ 5.24– $ 5.27.

- Resistance concentrated at $ 5.39- $ 5.42.

- Midnight volume Spike: 3.13m Average VS units of 876k.

- 1:00 am Spike volume: 6.93m units.

- Breakout above $ 5.36 resistance with volumes of 27,887-39,904 units.

- New intra-formed support formed at $ 5.33- $ 5.34.

- Strong purchase interest during consolidation phases.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.