Link, Oracle Service Chainlink’s native token has recently been under pressure, since several positive headlines could not break the decrease.

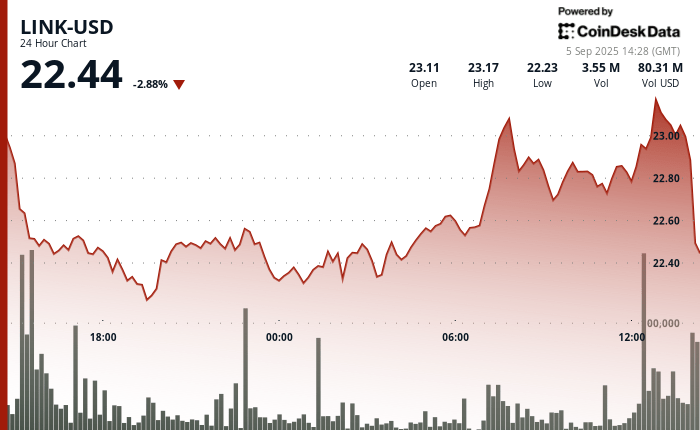

The Token slid another 2.8% in the last 24 hours to $ 22.4, while the broader market, measured by the Coindesk 20 index, changed little, show Coindesk data. It is quoting 15% lower since it exceeded $ 27 on August 22, despite having been used by the United States government to publish economic data in the block chain and the presentation of Bit A bit a bit for a negotiated background with link exchange with exchange of links (ETF).

The cooling period follows a rally that saw the Token reserve a gain of 37% in August, one of the strongest advances among the main crypts. It also coincides with Bitcoin ether (Eth) and the broader cryptographic market that has been withdrawn since mid -August.

The losses occurred despite the fact that the Chainlink reserve, an automated mechanism that buys tokens weekly, essentially took them out of circulation and reduces the supply, bought another link of 43,937 on Thursday. Since its debut in early August, the mechanism has bought a total of 237,014 tokens, with a value of $ 5.5 million at current prices.

Technical analysis

- The link found a persistent bearish pressure, forming lower and lower high ups and downs, since the broader cryptographic market is in a period of consolidation, according to the technical analysis model of Coindesk Research.

- Key levels of technical support established around $ 22.28- $ 22.32.

- A strong resistance supported by volume was formed around the level of $ 23.10- $ 23.16.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.