The US Treasury Market. It is experiencing its greatest volatility in four months, which can endanger a expected Bitcoin price recovery (BTC).

The inflation data of the United States for February arrived in softest than expected, strengthening the case of the Federal Reserve interest rate cuts. Reading encouraged some analysts to forecast a Bitcoin price recovery at $ 90,000 and more. It is currently around $ 82,000.

“With the cooling of inflation and the fears of recession still progressing but not getting worse, Bitcoin could be on the edge of his next great rupture, overcoming the stubborn range of less than $ 90K,” said Matt Mena, cryptographic research strategist in 21Shares, in an email.

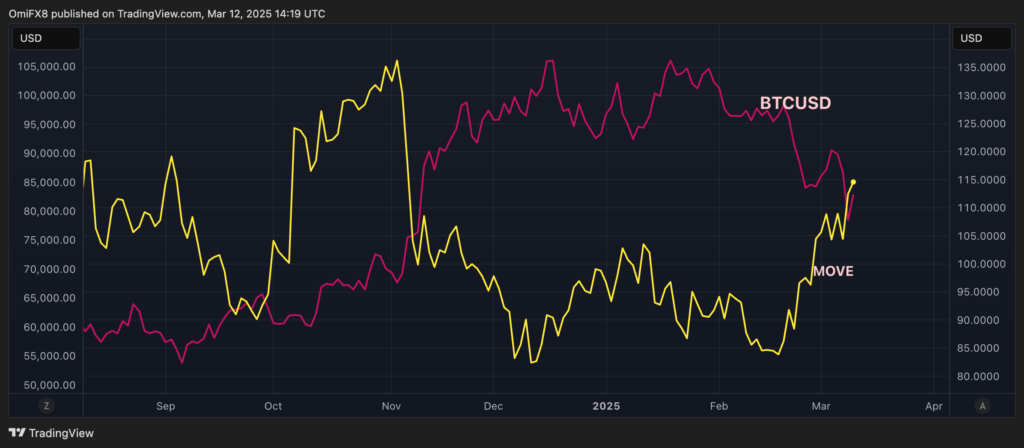

However, any increase in improvement could develop slower than expected since the Volatility Estimation Index of the Merrill Lynch (Movement) option, which measures the expected volatility of 30 days in the US Treasury market. UU., Has increased to 115, the highest since November 6, according to the commercial vision of the data source. It has jumped 38% in three weeks.

Greater volatility in the United States Treasury notes, which dominate the global guarantee, values and finance, negatively affect leverage and liquidity in financial markets. That often leads to a reduction in risk taking in financial markets.

The movement index collapsed after the elections of November 4, relieving the financial conditions that probably helped the increase of BTC to $ 108,000 from $ 70,000.

The cryptocurrency rally reached its maximum point in December to January as the movement touched.