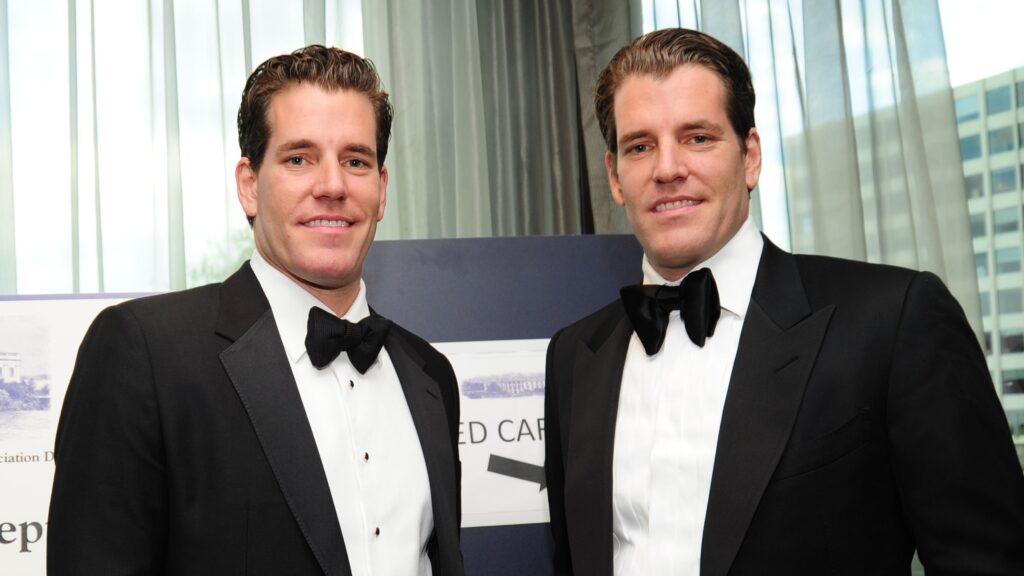

Gemini Space Station Inc., the Crypto exchange and custody platform founded by Cameron and Tyler Winklevos, has taken a significant step to become a company that lies on the stock market.

The firm announced on Friday that it has confidentially submitted a draft registration declaration in Form S-1 with the US stock and values commission. UU. (SEC), indicating its intention to follow an initial public offer (IPO) of its ordinary actions of class A.

While the specific details on the size and assessment of the offer remain without revealing, the movement places Gemini among a growing list of crypto-national companies that seek a support point in traditional capital markets.

The exchange of encryption has been taking important measures to make public in the United States, including the hiring of Goldman Sachs and Citigroup as financial advisors for the OPI. Gemini had also resolved a $ 5 million lawsuit by the Basic Products Future Trade Commission, while the SEC finished its investigation into the exchange earlier this year.

The synchronization is aligned with a renewed interest in the OPI of digital assets after stablecoin emitter circle (CRCL) began to quote on the New York Stock Exchange (NYSE) this week. Circle shares increased on their first negotiation day on Thursday, closing to $ 83 after leaving public to $ 31. The action is currently quoting around $ 113, almost 264% higher than its OPI price.

Gemini’s offer, if completed, would mark an important milestone not only for Gemini but for the continuous search for the cryptographic industry of conventional financial legitimacy.

The company noted that the OPI will proceed after the review of the SEC and the pending market conditions, according to the standard dissemination protocols.

Read more: Circle shares in Nyse’s debut, indicating a strong appetite for Stablecoin emitters