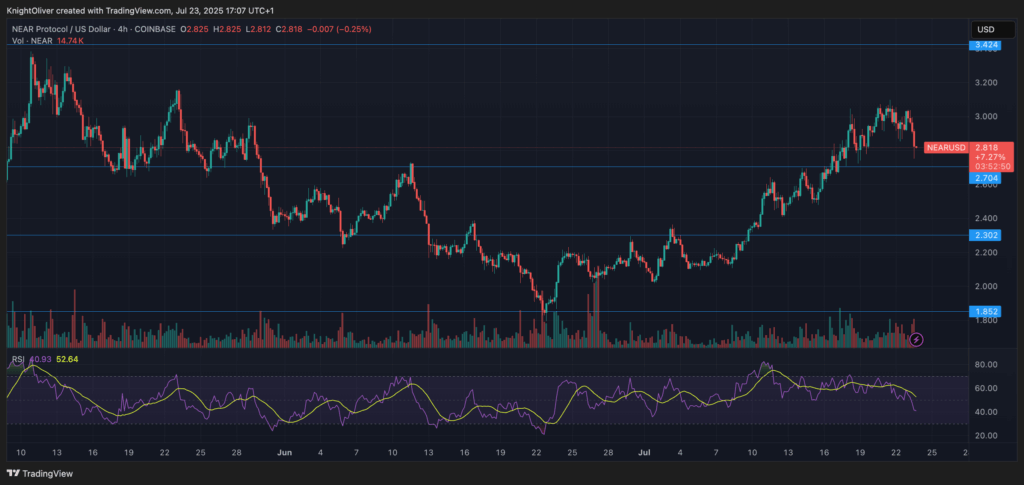

Near the protocol he endured a turbulent 24 -hour stretch between July 22, 3:00 p.m. and July 23, 14:00, decreasing from $ 2.97 to $ 2.81 in a 5.41% movement that highlighted a broader weakness throughout the Altcoin complex.

The Token quoted within a volatile range of $ 0.28, reaching a maximum of $ 3.04 before falling to an intradic minimum of $ 2.76. The most acute sale arose during the 1:00 p.m. on July 23, since it almost fell from $ 2.84 to $ 2.76, with commercial volumes that increased to 14.19 million tokens, almost five times its average of 24 hours.

This dynamic established a significant resistance to $ 2.84, suggesting that merchants will observe that level to obtain reversion signs.

For a critical hour from 13:10 to 14:09 UTC, almost briefly stabilized after falling 2.46% of $ 2.84 to $ 2.77, before recovering at $ 2.80.

The intensity of the trade reached its maximum point between 13:41 and 13:51 when more than 850,000 units changed hands per minute, highlighting the support fragility about $ 2.76.

While the rebound suggests a possible short -term consolidation, the softness of the Altcoin Altcoin market raises questions about whether you can keep an upward boost.

In addition to the mixture, the association close to the foundation with Everclear to develop the cross -chain settlement infrastructure could act as a catalyst for a renewed interest. Meanwhile, merchants continue to look at the emergence of narrative projects such as Magacoin Finance, which has diverted speculative capital as close with development delays that are directed to the fourth quarter of 2025.

Technical analysis

- Price Action: A 5.41% of $ 2.97 to $ 2.81 (July 22-23) fell close, with a negotiation range of $ 3.04 (high) to $ 2.76 (bass).

- Peak volume: 14.19m tokens exchanged during the peak of sale, well above the daily average of 2.89m.

- Resistance level: $ 2.84 established as significant general resistance after multiple failed reestimations.

- Support level: $ 2.76 kept as a key floor during high volume volatility.

- Altcoin context: The widest weakness of the market weighs on the recovery prospects closely.

Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.