Islamabad:

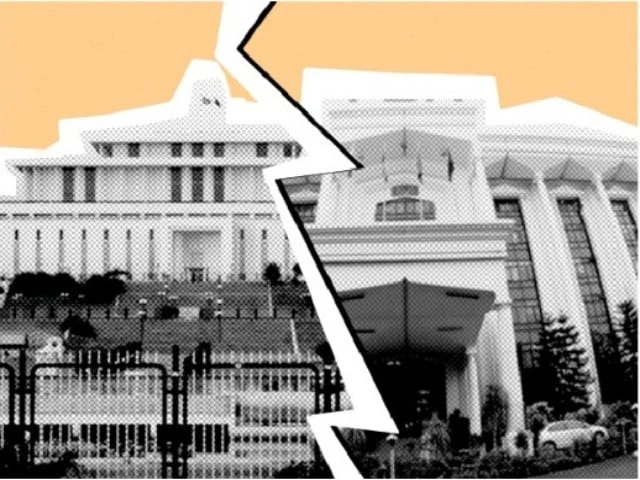

The president of the Pakistan office said Wednesday that the orders of the Head of State cannot be challenged in any court. The declaration occurred after the Federal Income Board (FBR) obtained an order of suspension of a provincial court against the president’s decision in a tax issue on MH merchants.

The unique case shows the state bodies in disagreement. President Fbr Rashid Langial repeatedly told the Permanent Senate Committee on Finance that the FBR could not even think about challenging the president’s orders.

Directed by Senator Salem Mandviwalo, the Committee assumed the non -implementation of a presidential order. The president’s office had issued the order in July of this year, but the FBR did not comply with it.

“The president’s orders are of an absolute nature and, to the head of state, no agency or department can challenge them anywhere,” said Zia Basit, legal general director in the president’s secretariat.

In July of this year, the President’s Secretariat accepted the representation of MH merchants in a case of erroneous classification of imported goods. The FBR had classified imported products as polyester fabric, while the importer had declared them as artificial leather to be used in football manufacturing.

The importer went to the federal tax defender office, which rejected the request for reasons for jurisdiction. MH merchants, together with another importer, challenged the order of the FTO before the president. The president set aside the orders of FBR and the FTO.

Last month, the FBR went to the Superior Court of Sindh against the president’s order and obtained a stay.

Langrial said that the FBR did not challenge the order to the president’s ability as head of state. He said that the FBR challenged him as an appeal authority that has quasi -auditional powers in fiscal matters.

“I don’t know where this concept of quasi -audicial power came, since the president has absolute authority,” said the legal general director.

In September of last year, the president’s secretariat wrote to the secretary of the Prime Minister. He sought clarity on how to enforce the president’s orders in representations against the findings of the Ombudsman.

Subsequently, the Prime Minister’s office instructed the Division of Law and Justice to issue addresses to all ministries and divisions. They were told to strictly observed section 18 of the Federal Law on Institutional Reforms of the Ombudsman, 2013 (Foira) when it comes to cases and appeals already decided by the Ombudsman or the President as an authority of appeals.

He also told them to withdraw the appeals and representations, if any, presented against the orders of the Federal Ombudsman or the President. These appeals were called violators of section 18 of the law.

In December, the Law Division issued binding orders to all ministries. On Wednesday, Basit produced these instructions before the Permanent Committee of Finance of the Senate.

The Law Division declared that the provisions contained in Section 18 of the Federal Law of Institutional Reforms of the Ombudsman, 2013 must be observed strictly while it comes to cases and appeals that have already been decided by the Federal Ombudsman or the President as an authority of appeal. He also said that appeals and representations, if any, against the orders of the Federal People’s Ombudsman or the President, must be withdrawn by violation of section 18 of the Ibid Law.

According to the written response of the FBR to the Permanent Committee, M/S merchants MH imported products declared as artificial leather under a tax regime concessionaire for football manufacturing. However, customs laboratory tests described the products “Printed polyester fabric, no leather PU”.

The FBR also declared that the importer was not registered as a manufacturer. Registration is a previous requirement to take advantage of the concessionary import. The FBR decided to judge the importer, but instead of joining the adjudication procedures, the importer filed a complaint with the Ombudsman of the Federal Tax.

The FTO dismissed the complaint, citing the lack of jurisdiction. The importer then presented a representation before the president of Pakistan.

The president’s office revoked the order of the FTO and granted relief to the importer. However, the Customs College challenged the president’s order before the Superior Court of Sindh, which granted a stay in favor of the FBR.

The FBR told the Permanent Committee that “the president cannot assume jurisdiction when the FTO has expressly rejected it.” He said that an erroneous classification order had already been issued against the importer, that the importer had challenged in the Customs Court.

“Challenge the president’s order in the instantaneous case does not violate the instructions in the Cabinet Division,” said the FBR. “These instructions only prevent the challenges in which the President defends the decision of the Fto. Here, the President’s order contradicts the decision of the FTO.”

But the legal DG of the president’s secretariat revealed that the 2016 instructions of the cabinet, which allow the FBR to go to court when the orders of the FTO and the president contradict, had already been canceled. He said that the new instructions of the law division prevent such acts of the FBR.

The FBR declared that, if its position is not accepted, the 1969 Customs Law and the allied laws would become useless. Instead of following the award procedures prior to the Supreme Court of Pakistan in the appeal stage, merchants would prefer to seek relief directly from the president’s office. That would create serious application problems for FBR field formations throughout the country.

The FBR said that MH merchants were operating only sewing and knitting machines to sew clothes, without football manufacturing evidence.

The president of FBR said the department had also sought clarifications from the office of the Pakistan Attorney General. He said that if the attorney general did not support the position of the FBR, the department would withdraw the case of the Superior Court of Sindh.

The committee postponed the matter until the next hearing.