Oracle Network Chainlink token native It declined together with the broader cryptocurrency market despite a new association with the Japanese financial giant Sbi Group.

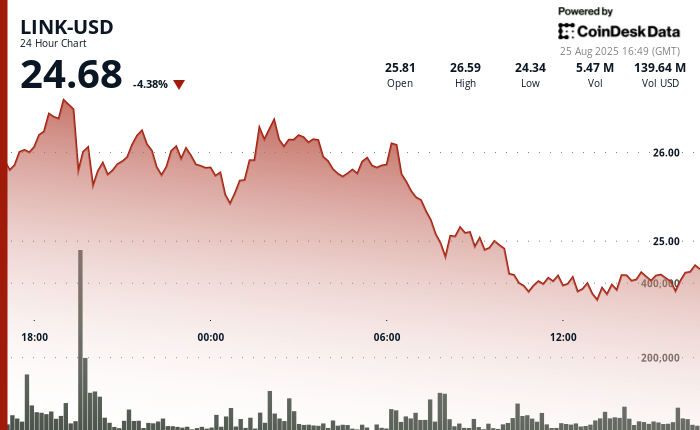

Link decreased to $ 24.4, more than 6% in the last 24 hours, according to Coindesk data. That is an acute investment of the peak of the year until Friday in more than $ 27.

The descending trajectory accelerated through successive trade sessions with persistent lower peaks, while the final time exhibited stagnation with an insignificant volume, which suggests a possible consolidation, according to the technical analysis model of COINDESK Research.

On the news side, SBI Group, one of the largest financial conglomerates in Japan, said Monday that he has partnered with Chainlink to develop tokenized assets and Stablecoin solutions in Japan, with future plans to expand to other Asia-Pacific markets.

SBI will use the Chainlink cross -chain interoperability protocol (CCIP) to support transactions in different blockchains while maintaining compliance. Companies will also analyze the tokenized funds by bringing data of net assets in the chain and exploring the payment settlement against payment for foreign exchange and transactions. The Chainlink reserve test will be used to verify Stablecoin reserves.

SBI and Chainlink have previously collaborated under the Guardian project of Singapore, a monetary authority of Singapore (Further) Initiative that explores the use of blockchain in finance.

Analysis of technical indicators

- Resistance established at $ 26.61 with an acute investment in high volume activity.

- Critical support arose at $ 24.37 with purchase interests.

- Extraordinary volume of 7,850,571 units during maximum volatility, which substantially exceeds the 24 -hour average of 2,687,393.

- Maximum systematic maximum formations that indicate acceleration of bearish impulse.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.