By James van Straten (All Times et unless indicated otherwise)

Bitcoin (BTC) continues to raise the wall of concern, pushing above $ 97,000 despite the inflation reports of consumers and producers of hottest American consumers in recent days. That is a surprise. With the increase in prices and the probability that a Fed Rate Rate cut would expect risky investments such as cryptocurrencies to stop, at least.

The buoyant behavior is possibly supported by the signs that inflation is still considered to decrease in the coming months.

“Bitcoin could probably obtain some relief in the short -term trial for the high frequency inflation indicator for the trufflation that suggests a significant decrease in the inflation of the main ones in the coming months,” said Andre Dragosch, head of research manager European a bit a bit in achieve. The US Truflation Inflation Index currently shows 2.06%, indicating a possible decrease.

Dragosch also pointed out the cautious position of the Federal Reserve, which suggests that the Central Bank is very aware of what happened in the 1970s, when three waves of inflation reached 6.2%, 12%and 15%peaks.

“The Fed is afraid of the inflation scenario of the 1970s, so it takes a more cautious approach at this time and is afraid to reduce rates too aggressively,” he said.

All of that means that the bitcoin upward market is far from finishing if historical trends are maintained. Take a look at the 200 -week mobile average (a period of almost four years!). It is currently around $ 44,200, below the peak of the previous market of $ 69,000 since November 2021. In the past, the average has increased towards the previous record, a movement that implies a greater growth of card prices.

Also consider that short -term holders have accumulated 1.5 million bitcoin since September, which shows the continuous demand of investors who tend to maintain their BTC for less than 155 days.

In the front of the public company, Coinbase followed Robinhood with strong profits and Gamestop is reflecting on an investment in Bitcoin, another potential catalyst for the market. Stay alert!

What to see

- Crypto:

- Macro

- February 14, 8:30 am: The United States Census Office releases January retail sales.

- Mom estorist sales -0.1% vs. Prev. 0.4%

- Retail sales Yoy Prev. 3.9%

- February 18, 10:20 am: President and CEO of the Fed of San Francisco Mary C. Daly pronounces a speech at the Conference for Community bankers in Phoenix. Live broadcast link.

- February 19, 2:00 pm: The FED launches minutes of the FOMC meeting from January 28 to 29.

- February 14, 8:30 am: The United States Census Office releases January retail sales.

- Earnings

- February 18: Coinshares International (CS), before the market

- February 18: Semler Scientific (SMLR), Post-Market

- February 20: Block (XYZ), Post-Market, $ 0.88

- February 26: Mara Holdings (Mara), $ -0.13

Token events

- Government votes and calls

- You unlock

- February 14: Starknet (STRK) Unlock 2.48% of the circulating offer for a value of $ 15.19 million.

- February 15: SEI (SEI) will unlock 1.25% of the circulating offer worth $ 13.46 million.

- February 16: Arbitrum (ARB) Unlock 2.13% of the circulating offer worth $ 46.2 million.

- February 16: Avalanche (AVAX) Unlock 0.4% of the circulating offer worth $ 43.55 million.

- February 21: Rapid Token (FTN) to unlock 4.66% of the circulating offer for a value of $ 78.8 million.

- February 28: Optimism (OP) to unlock 2.32% of the circulating offer for a value of $ 36.67 million.

- Lanza Token

- February 14: The grocery penguins (PEGUM) will be listed in Coinbase, according to a publication shared by the Pudgy Penguins account.

Conferences:

Coindesk’s consensus will be carried out in Hong Kong from February 18 to 20 and in Toronto from May 14 to 16. Use the code code and save 15% in passes.

Token talk

By Francisco Rodrigues

The founder of Binance and the dog of former CEO Changpeng Zhao has been the city’s talk. After revealing that he had the pet and be bombarded with requests for information, he finally yielded, knowing that memecoins would be launched.

Zhao shared a photo of himself with the Belgian Malinois called broccoli in a long publication that inspired a memecoins. These chips, which are negotiated under the Broccoli ticket, debuted both in the BNB and Solana chain.

Some saw significant price increases just after their introduction to reach the market limits of more than one billion dollars as the merchants rushed. As the hype faded, prices did so. They became fortunes and sold on the broccoli.

A merchant, for example, spent less than $ 1,000 to create a dog inspired and began selling tokens only two minutes later. The merchant managed to win $ 6.5 million in the launch, as Danny Nelson de Coindesk reported.

Volatility affected the price of BNB itself, which is now 6.6% lower in the last 24 hours, while Bitcoin and Ether are slightly high. The pancakeswap cake token, which rose more than 70% in the week, has dropped 18% in the same period.

In other places, the protocol defended by Trump WLFI has continued to accumulate tokens, buying around $ 5 million in Bitcoin wrapped (WBTC) and $ 1.4 million movement (movement).

Derivative positioning

- XRP perpetual financing rates remain slightly negative, indicating a bias for shorts despite an increase in prices of 10%. If prices continue to increase, these shorts can throw the towel, quading their bets and increasing an upward movement in prices.

- LTC, XLM and DEGE have seen net purchase pressure in perpetual futures, according to the cumulative volume delta adjusted by open interest tracked by veil data.

- The BTC CME futures base remains below the ETH base.

- The block flows in Delibit presented long calls out of money and a bull call. In ETH, a purchase option was presented on the $ 3,300 strike at the March Expiration, according to Amberdata.

Market movements:

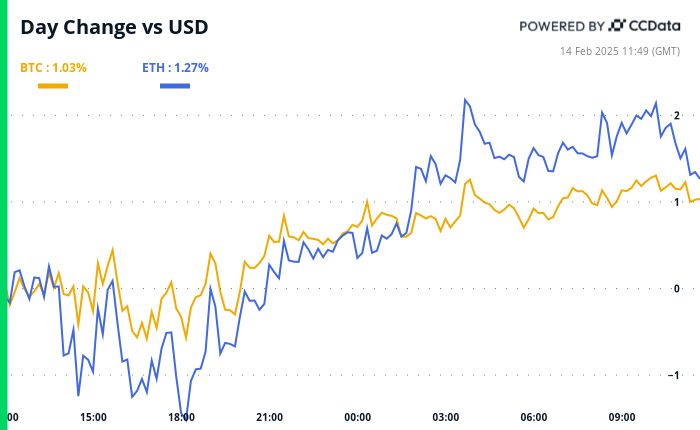

- BTC increased 0.57% from 4 pm et on Thursday to $ 97,093.36 (24 hours: +0.96%)

- ETH has increased 1.39% to $ 2706.09 (24 hours: +1.13%)

- COINDESK 20 increases 3.70% to 3,324.03 (24 hours: +3.85%)

- The reference rate composed of Ether increases 1 PB to 3.06%

- The BTC financing rate is at 0.0035% (3,8632% annualized) in Binance

- DXY has dropped 0.32% to 106.97

- Gold has increased 1.17% to $ 2,960/oz

- La Plata rises 4.32% to $ 34.06/oz

- Nikkei 225 closed -0.79% to 39,149.43

- Hang Seng closed +3.69% at 22,620.33

- Ftse has dropped 0.26% to 8,741.88

- Euro Stoxx 50 does not change to 5.501.78

- Djia closed Thursday +0.77% to 44,711.43

- S&P 500 closed +1.04% at 6,115.07

- Nasdaq closed +1.5% to 19,945.64

- The closed S&P/TSX compound index +0.53% at 25,698.5

- S&P 40 Latina America closed +0.69% to 2,438.53

- The 10 -year Treasury rate from US

- E-mini s & p 500 futures have dropped 0.1% to 6,129.25

- E-mini nasdaq-100 futures have not changed to 22,107

- E-mini dow Jones The industrial average index has been reduced to 44,686

Bitcoin statistics:

- BTC domain: 60.58 (-0.63%)

- Bitcoin Ethereum Relationship: 0.02783 (0.47%)

- Hashrat (seven -day mobile): 818 eh/s

- HASHPRICE (SPOT): $ 54.1

- Total rates: 5.67 BTC / $ 546,770

- CME Futures Open Interest: 167,750

- BTC with a gold price: 33.0 oz

- BTC vs Gold Market Cap: 9.37%

Technical analysis

- XRP has bounced on the Ichimoku cloud support, keeping intact the broader bullish perspective.

- Prices seem to go towards the resistance of the descending trend line, which, if it is overcome, will probably give a movement to the registered maximums.

- A potential movement under the cloud would indicate a change in bearish trend.

Cryptographic equities

- Microstrategy (Mstr): closed on Thursday at $ 324.92 (-0.58%), 0.6% more at $ 327.03 in the previous market.

- Global Coinbase (Coin): Closed at $ 298.11 (8.44%), less 1% at $ 295.12.

- Galaxy Digital Holdings (GLXY): closed at C $ 28.37 (+5.58%)

- Mara Holdings (Mara): closed at $ 16.91 (+4.13%), 0.65% lower $ 17.02

- Riot Platforms (Riot): closed at $ 12.23 (+9.59%), 0.1% more at $ 12.24.

- Core Scientific (Corz): closed at $ 12.54 (+3.72%), 0.32% at $ 12.50.

- CleanSTark (CLSK): closed to $ 10.67 (+1.43%), 0.66% lower $ 10.74.

- Coinshares Valkoie Bitcoin Miners ETF (WGMI): closed at $ 23.28 (+2.42%), minus 1.12% at $ 23.02.

- Semler Scientific (SMLR): closed to $ 49.45 (+3.69%), an increase of 1.86% to $ 50.37.

- Exodus movement (exod): closed at $ 50.00 (+2.35%), less than 3.34% at $ 48.33.

ETF flows

Spot BTC ETF:

- Daily net flow: -$ 156.8 million

- Cumulative net flows: $ 40.05 billion

- Total BTC holdings ~ 1,171 million.

Spot Eth Ethfs

- Daily net flow: $ 12.8 million

- Cumulative net flows: $ 3.14 billion

- Total eth holdings ~ 3,777 million.

Source: Farside Investors

Flows during the night

Figure of the day

- The table shows yields in the 10 -year and two -year treasure notes.

- The 10 -year yield has decreased by 27 basic points in four weeks, while the two -year performance has fallen 10 basic points.

- The so -called bull flattening of the treasure performance curve is a positive sign for risk assets, according to some observers.

While you sleep

In the ether