Ethher (ETH) has fallen 39% this year in relation to Bitcoin (BTC), the largest cryptocurrency, taking the relationship between the two and the lowest in almost five years, since a more risky macroeconomic environment weighs in the second largest cryptocurrency.

At the current level, 1 ETH is the equivalent of 0.02191 BTC. That is less since May 2020, when Ether quoted around $ 200 and Bitcoin just under $ 10,000. Today the ETH price is approximately $ 1,800 and the price of BTC around $ 82,000.

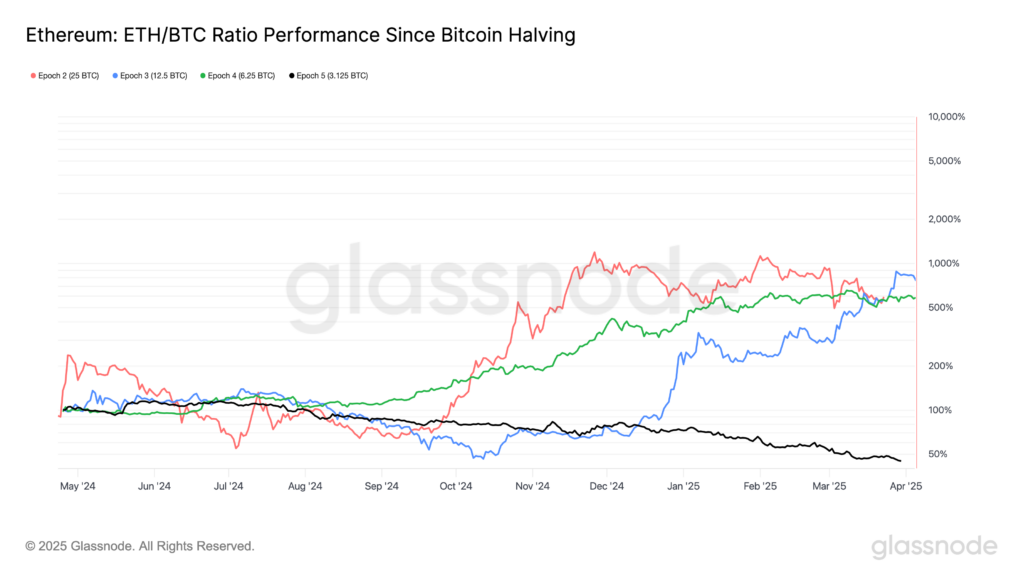

Low performance is remarkable because it is the first time that Ether weakens Bitcoin in the 12 months after a BTC reward in half. On April 20, 2024, the payment received the Bitcoin miners to confirm blocks in the block chain was reduced by 50% to 3,125 BTC.

In half -previous cycles, Ether beat Bitcoin in the first year after one half. This time, the relationship has decreased by more than 50%.

That is partly due to the fact that the threat of a commercial war driven by the rate, persistent inflation and high yields of bonds worldwide have brought investors to the assets considered more liquid and less risky. Gold, the final shelter, has risen to the maximum record, and in the cryptocurrency market, Bitcoin is considered a safer bet than the ether.

This relative performance also marks one of Ether’s worst quarterly actions against Bitcoin in several years, according to Glassnode data. The last time Ether had a performance lower than Bitcoin in a similar degree was in the third quarter of 2019, when the relationship fell to 0.0164, a quarterly decrease of 46%.

This current fall reflects the low performance observed in 2019 and further highlights the relative weakness of Ether, especially compared to other layer 1. Soleth ratio assets, which measures the Sol of Solana’s value in relation to the ether, increases 24% in the year to 0.07007. This indicates that Sol has significantly exceeded Ether in 2025, although the token itself decreased 35% in the year to date.

Update (March 31, 9:25 UTC): Add a macroeconomic environment in the fifth paragraph.