Bitcoin (BTC) options worth billions of dollars will expire on Friday. The imminent, although large settlement may not produce significant market volatility, the exchange to Coindesk told.

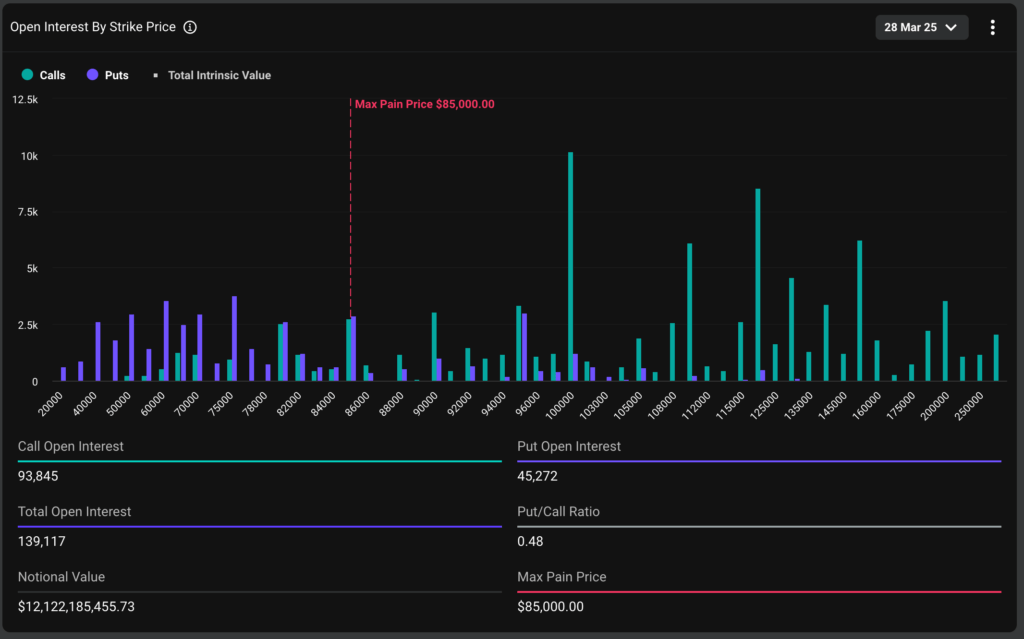

More than 139,000 BTC options contracts, with a value of $ 12.13 billion, representing almost 45% of the total BTC active contracts in all expired, must be settled this Friday, according to Data Foull Fauring Metrics.

More than 65% of the total open interest is concentrated in the purchase options that provide buyers an asymmetric bullish exposure, while the rest is on dropout options.

It is known that the quarterly expirations of such mass magnitudes raise market volatility, but that may not be the case this time, through the continuous decrease in the 30 -day implicit volatility index (DVOL) of 30 days. The index has decreased from 62% annualized to 48% in the weeks prior to expiration, which suggests moderate volatility expectations.

Similar conclusions of the annualized base of perpetual futures of about 5% in the exchange can be drawn, indicating a quieter financing environment.

“Despite the size of the chain, the general configuration (Dvol Baja, a moderate base and the positioning of balanced options) points to a relatively moderate expiration unless external catalysts arise,” said Luuk Strijers, CEO of Deribit, to Coinridesk.

Some inconvenient coverage are seen

The Siagar options, which measures the difference between implicit volatility (prices) for calls in relation to PUT, shows downward concerns in the period prior to the expiration of Friday.

That said, the broader perspective remains constructive.

“The 3 -day lime bias is slightly positive, indicating an immediate demand for downward protection, while 30 -day draft bias is slightly negative, indicating a more medium -term bullish perspective,” Strijers said.

Ether options (ETH) also expire on Friday worth $ 2.8 billion.