A key indicator is red flashing for Shiba Inu (Shib), since the recent price drop to the minimum of two months has shaken the leverage bullish bets.

The indicator in consideration is the long -term relationship derived from the market of perpetual futures. It measures the number of active lengths or bullish bets in relation to the shorts, providing signals about the feeling of the market.

The relationship has fallen to 0.9298, indicating a bassist feeling among merchants, according to AI de Coindesk. This follows the forced closure or the liquidation of long positions worth more than $ 1.8 million since June 12, according to the data source coingle. Exchanges liquidate positions due to margin shortage. The dollar value of squeezed shorts during this period is less than $ 500,000.

In the last 24 hours, the derivative market has exhibited a growing caution, with an open interest that decreases by 2.14% to $ 145.33 million and long liquidations increase to $ 244,000, compared to only $ 57,000 in short liquidations.

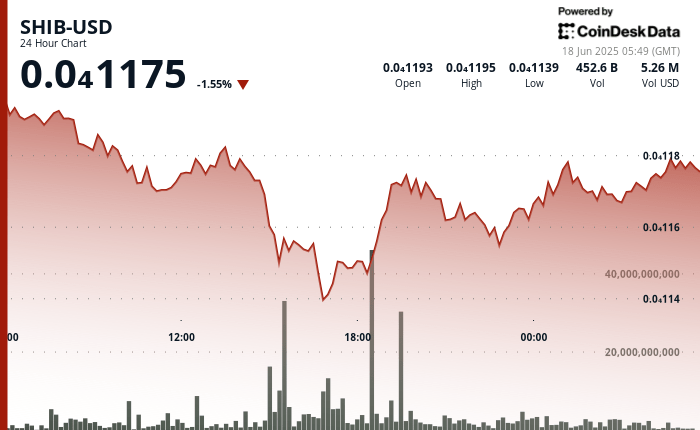

The price of Shib has decreased by 10% to $ 0.00001164 from June 12, according to Data Source Coindesk. The minor recovery of the minimum of two months on Tuesday from $ 0.00001134 is providing bullish suggestions in short -term price graphics.

Key insights

- Shib continues to maintain support above the critical level of $ 0.00001100, indicating a possible investment of trends.

- The technical analysis reveals a lower uprising divergence in the daily RSI, with MacD and signaling lines that approach a bullish crossover that could boost SHIBH for the Fibonacci level to 23.60% at $ 0.00001390.

- Volume higher than the average interest of the buyer confirmed with the closing price of $ 0.00001170, which suggests stabilization above the critical support.

- The RSI per hour indicates overall conditions, potentially configuring a technical rebound if the support level of $ 0.00001168 is maintained.