On Tuesday on Tuesday, a precautionary movement as the stellar network prepares for its protocol 23, a precautionary measure, a caution movement while the stellar network prepares for its protocol 23.

Programmed modernization, scheduled for September 3, is expected to improve the transaction speeds, leading to several exchanges to adopt stability measures during the transition.

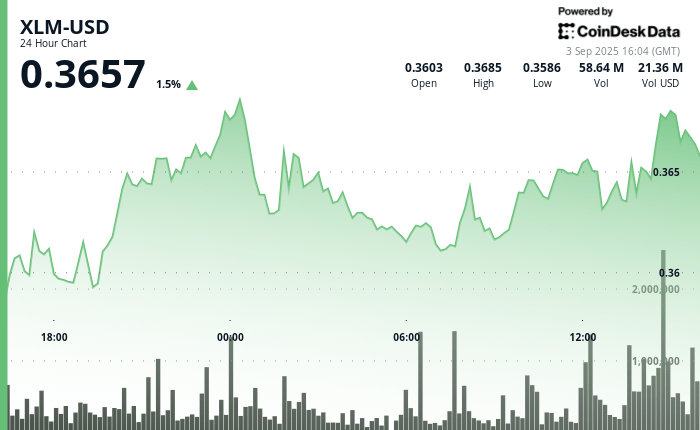

XLM negotiated in a narrow band between $ 0.36 and $ 0.37 in the 24 hours prior to the update, with volume peaks that coincide with resistance tests at the upper end of that range.

Despite multiple attempts to break $ 0.37, the sales pressure kept limited prices, while a strong support was formed at $ 0.36. Analysts suggest that this consolidation reflects institutional accumulation, and market participants closely observe a decisive breakup.

The last time of negotiation before the suspension saw greater volatility, with XLM briefly touching $ 0.37 before falling back to $ 0.36. The price action underlines the importance of the network in cross -border payments and the growing institutional approach in digital asset infrastructure.

The broader impulse is also being driven by the growing interest in the digital currencies of the Central Bank (CBDC) and Blockchain’s business adoption, including associations that involve Hedera.

With the update of the current Stellar protocol 23, the operators are observing two critical levels: the resistance of $ 0.45, that XLM has failed to erase four separated times since June, and the support zone of $ 0.30- $ 0.32, seen as an area of potential accumulation. Market observers say that the result of the update could dictate whether Stellar finally breaks their roof or retires to rebuild support at the lowest levels.

Main technical indicators

- Price parameters: XLM negotiated within a $ 0.36- $ 0.37 corridor during the 24-hour period with aggregate volatility of 3%.

- Volume evaluation: Maximum negotiation activity of 28.91 million during the threshold resistance exam of $ 0.37.

- Support/resistance dynamics: robust resistance established at $ 0.37 with support to maintain the integrity of around $ 0.36.

- Rupture configurations: multiple failed attempts to keep valuations above the resistance threshold of $ 0.37.

- Institutional participation: Volume increases with key technical levels suggest accumulation patterns among sophisticated market participants.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.