Strategy (Mstr) He announced another purchase of 1,955 BTC for $ 217 million on Monday, which carries the total holdings of the technology company up to 638,460 BTC, according to a presentation of the SEC.

Recent purchases were made to $ 111,196, raising the average purchase price of up to $ 73,880 Betcoin.

The announcement occurs when BTC increased from $ 110,500 to $ 112,200 on Monday morning, with prices that slightly slipped to $ 111,800 after the news appeared.

The measure occurs when Mstr has recently faced some criticisms of his shareholders, especially due to his promise of Mnav. The firm said in July that it will not issue any action if its MNAV was below 2.5x, only to discard the promise a month later, saying that it has modified the guide, allowing a possible dilution to its holders.

The metric, which is a relationship that shows the assessment of the actions compared to the value of Bitcoin’s holdings, has been reduced to approximately 1.5 times at the end along with a drop in the prices of Mstr’s shares. The action currently lies to $ 335, since it has lost 26% of its value since July.

The new purchases are also presented when the strategy was lost last week about the potential to be added to the S&P 500 index, surpassed by Robinhood (HOOD)Despite the hopes of inclusion after Mstr registered one of the strongest rooms in his history and fulfilled all the criteria to join the index.

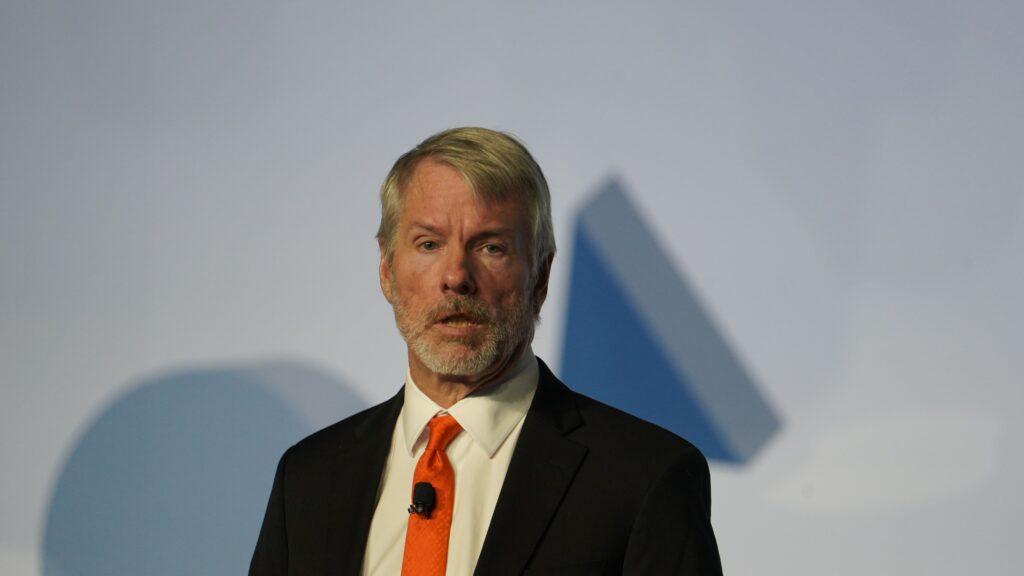

Read more: Michael Saylor’s strategy Desairada by S&P 500 in the midst of Robinhood’s surprise inclusion