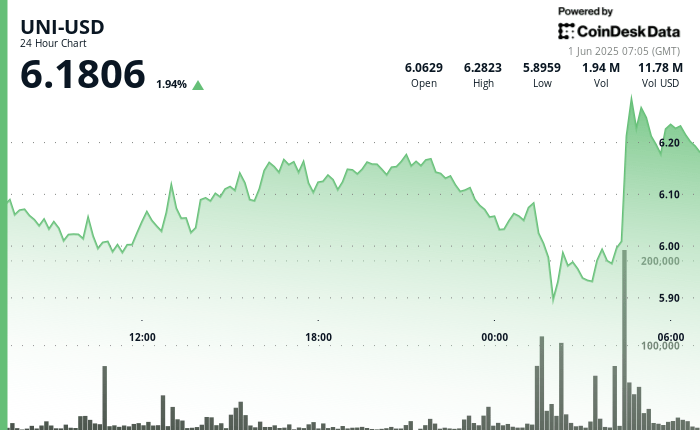

Uniswap’s native token initially broke below its bullish trend line after not being able to keep the impulse above the $ 6.00 support level.

The decrease followed the formation of an ascending channel earlier in the day, but that structure collapsed under the sale of high volume, including a peak of more than 1.4 million units as prices briefly touched $ 6.00.

However, the breakdown was temporary. Uni quickly reversed the course and returned to $ 6.18, indicating a strong salsa purchase interest and suggesting that the upward trend can still be intact if the support about $ 6.05 continues to have.

TECHNICAL ANALYSIS

- UNI formed a clear ascending channel for most of the day, with a notable support at the level of $ 6.00 backed by a volume higher than the average.

- There was an acute investment when Uni broke briefly below its bullish trend line, which caused the high volume sale.

- There were two significant volume peaks: more than 455,000 units at 01:38 and exceed 1.4 million units at 01:42.

- The Token quickly recovered after collapse, recovering land and pushing towards the area of $ 6.18.

- The initial resistance was found at $ 6.19, which now appears within reach again as the bullish impulse returns.

- The price action showed a substantial intradic range of 0.226 (3.78%), highlighting persistent volatility

External references