The token breaks key support while volume increases by 251% during the defense of the psychological level at $2.00.

News background

- US

- Institutional participation remains strong even as retail sentiment remains weak, contributing to market conditions where large players pile in during weakness, while short-term traders are hesitant to re-enter.

- XRP’s macro environment remains dominated by capital rotation into regulated products, with demand for ETFs offsetting declining open interest in derivatives markets.

Technical analysis

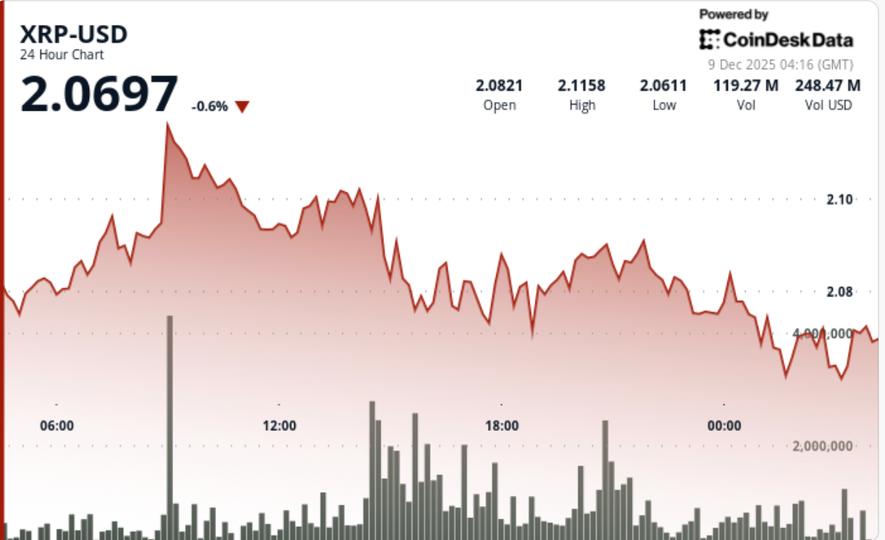

- The decisive moment of the session came during the surge from $2.03 → $2.00 when volume skyrocketed to 129.7 million, 251% above the 24-hour average.

- This confirmed strong selling pressure but, more importantly, marked the exact moment when institutional buyers absorbed liquidity at the psychological floor.

- The V-shaped bounce from $2.00 to the $2.07-$2.08 range validates the active demand at this level.

- XRP continues to form a series of higher lows on the intraday charts, indicating an early reacceleration of the trend. However, failure to break above the $2.08 to $2.11 resistance group shows persistent supply overload as the market awaits a decisive catalyst.

- Momentum indicators show that a bullish divergence is forming, but volume must expand during bullish moves and not just bearish moves to confirm a sustainable breakout.

Price Action Summary

- XRP traded between $2.00 and $2.08 during the 24-hour window, with a sharp sell-off testing the psychological floor ahead of immediate absorption.

- Three intraday advances towards $2.08 failed to clear resistance, keeping the price capped despite improving structure.

- Consolidation near $2.06-$2.08 at close of session indicates stabilization above support, although broader range compression persists.

What traders should know

- The $2.00 level remains the most important line in the sand, both technically and psychologically. Institutional buildup below this threshold suggests that larger players are preparing for medium-term expansion phases.

- A clear break above $2.11 is required to build momentum towards the next supply zone near $2.20-2.26.

- Failure to hold the $2.00 floor risks retesting the $1.95 area, where ETF-driven buying may reappear.

- The divergence between rising institutional demand and flat retail participation continues to create asymmetric bullish conditions if resistance levels are broken.